For the 24 hours to 23:00 GMT, the EUR declined 0.08% against the USD and closed at 1.1292, after the European Central Bank (ECB) President, Mario Draghi, pledged to increase stimulus measures further, if necessary.

Yesterday, the ECB left the monetary policy mix unchanged. The central bank held the main refinancing interest rate at 0.0%, the deposit rate at -0.4% and marginal lending facility at 0.25%. The ECB Chief indicated that inflation could turn negative in the coming months before picking up later this year. Further, he brushed off German criticism of his ultra-loose monetary policy and also stated that the outcome of UK’s Brexit referendum only poses “limited” risk to the Eurozone recovery.

In other economic news, the Euro-zone’s preliminary consumer confidence index rose to a level of -9.3 in April, in line with market expectations. In the previous month, the consumer confidence index had recorded a level of -9.7.

The greenback gained ground, after US initial jobless claims declined to a four-decade low level in the week ended 16 April 2016. Data showed that initial jobless claims fell unexpectedly to a level of 247.0K, compared to market expectations of a rise to 265.0K. Initial jobless claims had recorded a reading of 253.0K in the previous week. Moreover, the nation’s housing price index advanced in line with market expectations by 0.4% MoM in February, compared to a revised similar rise in the prior month. On the other hand, the Philadelphia Fed manufacturing index registered a level of -1.6 in April, suggesting that the nation’s manufacturing sector may still be struggling to shake off economic headwinds. Investors had expected it to fall to a level of 9.0. In the previous month, the index had recorded a reading of 12.4.

In the Asian session, at GMT0300, the pair is trading at 1.1301, with the EUR trading 0.08% higher from yesterday’s close.

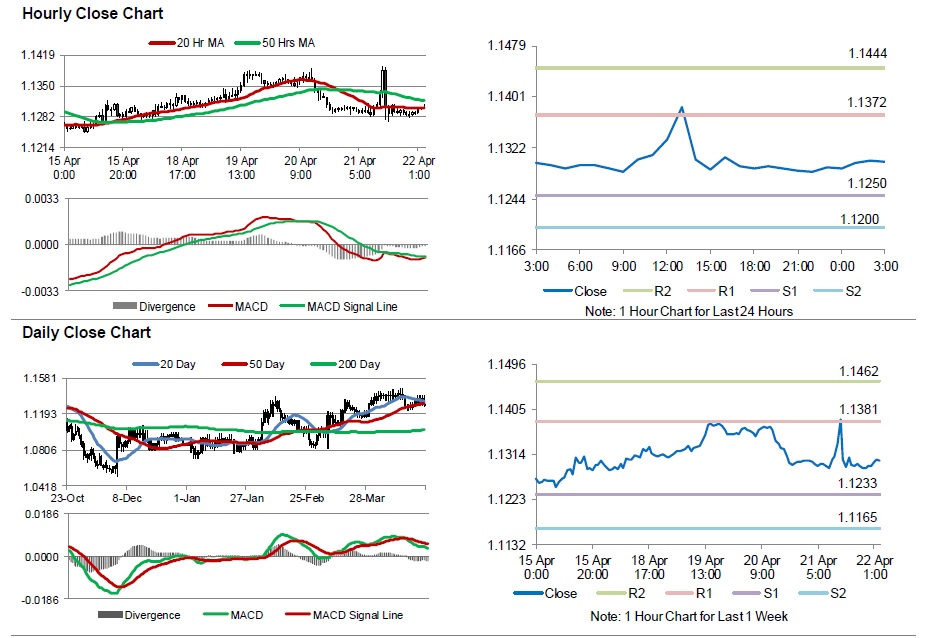

The pair is expected to find support at 1.1250, and a fall through could take it to the next support level of 1.1200. The pair is expected to find its first resistance at 1.1372, and a rise through could take it to the next resistance level of 1.1444.

Going ahead, market participants will look forward to the preliminary Markit manufacturing and services PMI data for April across the Euro-zone, scheduled to release in a few hours. Additionally, the US flash Markit Manufacturing PMI data for April, due later today, will also attract a significant amount of investor attention.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.