For the 24 hours to 23:00 GMT, the GBP fell 0.10% against the USD and closed at 1.4319, after UK’s retail sales declined for the second consecutive month in March.

Data showed that retail sales declined 1.3% MoM in March, in the latest sign that households are nervous about the nation’s economic outlook. Market anticipation was for retail sales to fall 0.1%, following a 0.5% revised drop in the previous month. Additionally, Britain’s public sector net borrowing posted a deficit of £4.2 billion, following a revised deficit of £6.3 billion in the prior month. Market anticipation was for public sector net borrowing to post a deficit of £5.4 billion.

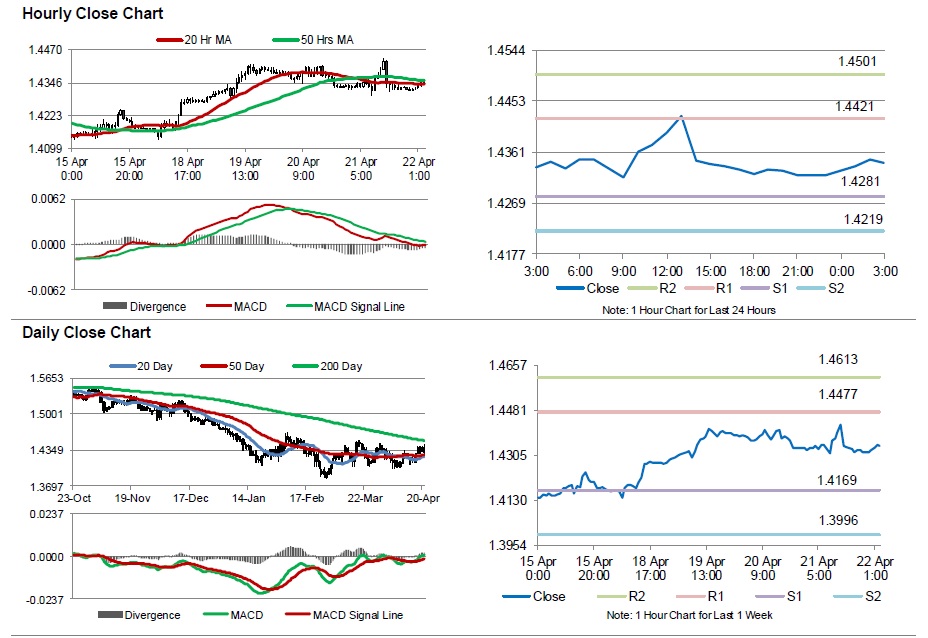

In the Asian session, at GMT0300, the pair is trading at 1.4342, with the GBP trading 0.16% higher from yesterday’s close.

The pair is expected to find support at 1.4281, and a fall through could take it to the next support level of 1.4219. The pair is expected to find its first resistance at 1.4421, and a rise through could take it to the next resistance level of 1.4501.

Amid no economic releases in Britain today, investors will look forward to the nation’s Q1 GDP, net consumer credit and the BBA mortgage approvals data, all scheduled to release next week.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.