For the 24 hours to 23:00 GMT, the EUR traded marginally lower against the USD and closed at 1.2847, after the manufacturing PMI in Germany, Euro-zone’s biggest economy dropped to 50.3 in September, marking its lowest level since June 2013 and lower than market expectations of a fall to 51.2. In the previous month, the index had registered a level of 51.4. Meanwhile, the services PMI in the nation unexpectedly advanced to 55.4, exceeding market expectations of a reading of 54.6. On the other hand, the services as well as manufacturing PMI of the Euro-zone for September deteriorated further, thus dampening optimism over the region’s struggling economy. Elsewhere, the French economy stagnated yet again on a quarterly basis in 2Q 2014.

Separately, the ECB Governing Council Member, Ignazio Visco, opined that the Euro-zone may struggle to recover from the economic crisis with high unemployment and weak investments adversely hitting highly indebted countries who are already suffering from disinflation. He further indicated that the Euro-zone would come back to its pre-crisis levels only in the late next fiscal.

In the US, the manufacturing PMI remained steady at 57.9 in September, compared to market expectations of a rise to 58.0. Meanwhile, the housing price index rose 0.1%, on a monthly basis, in July, lower than market expectations for a rise of 0.5% and compared to previous month’s revised gain of 0.3%. Additionally, the Richmond Fed’s composite index of manufacturing surprisingly rose to a level of 14.0 in September, up from previous month’s level of 12.0 and compared to market expectations to ease to a level of 10.0.

Yesterday, the St. Louis Fed President James Bullard, in a conference, stated that he expects the first move of hiking the interest rates by the Fed would be employed at the end of the first quarter 2015. Meanwhile, Minneapolis Fed Governor, Narayana Kocherlakota, in a speech, said that the inflation of the country would remain below target for the next few years and that the unemployment rate remains “unacceptably high” at current levels.

In the Asian session, at GMT0300, the pair is trading at 1.2854, with the EUR trading tad higher from yesterday’s close.

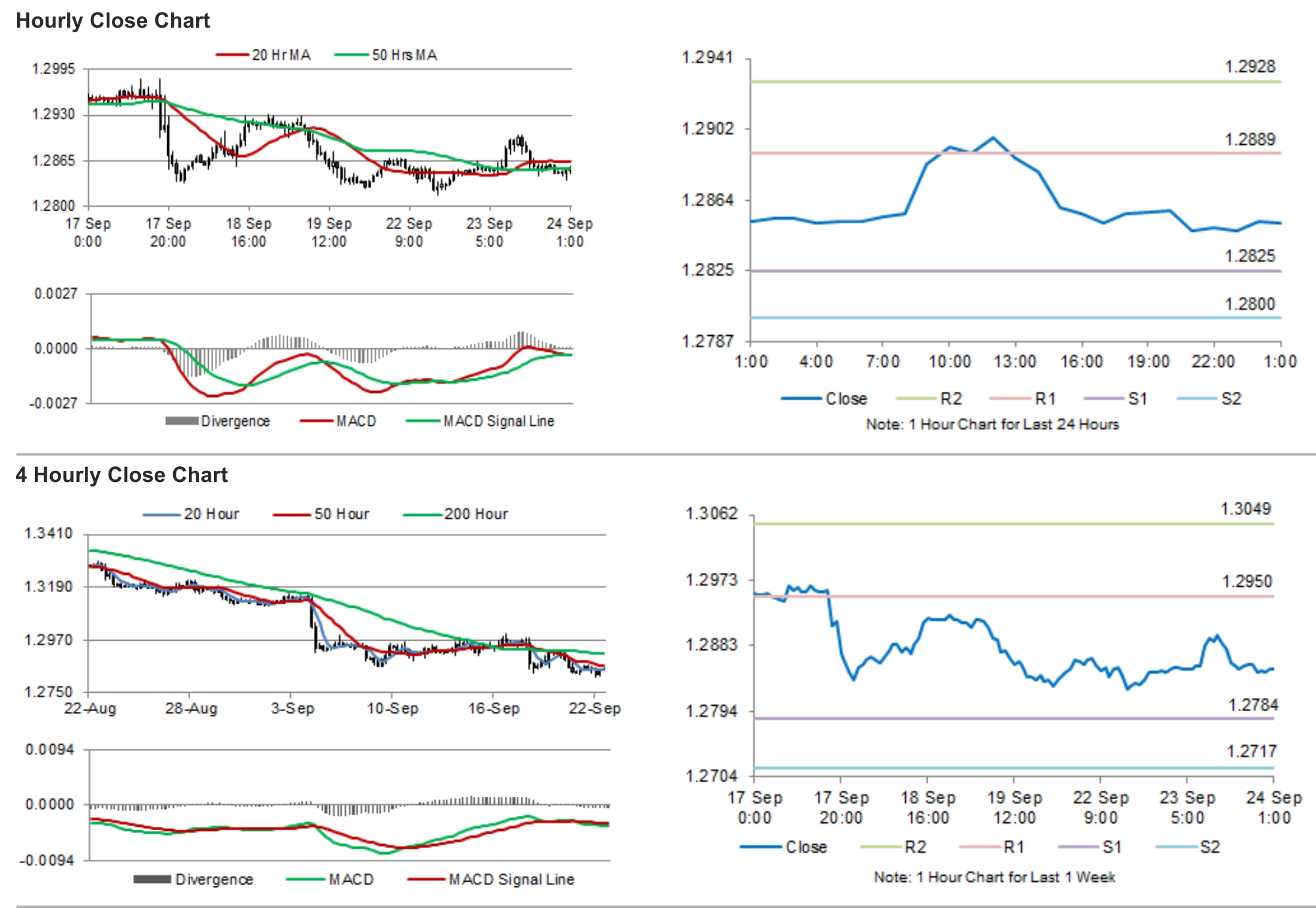

The pair is expected to find support at 1.2827, and a fall through could take it to the next support level of 1.2801. The pair is expected to find its first resistance at 1.2891, and a rise through could take it to the next resistance level of 1.2929.

Trading trends in the Euro today would be determined by the German IFO sentiment indices, set for release in a few hours.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.