For the 24 hours to 23:00 GMT, the GBP rose 0.15% against the USD and closed at 1.6391.

In economic news, the UK mortgage approvals registered an unexpected drop to a level of 41.6K in August, lower than market expectations of a rise to 42.9K and following a revised reading of 42.8K registered in the previous month. Meanwhile, Britain’s public sector net borrowing posted a surplus of £10.9 billion in August, following a revised deficit of £0.5 billion in the prior month and compared to market anticipations to show a surplus of £10.5 billion.

In the Asian session, at GMT0300, the pair is trading at 1.64, with the GBP trading marginally higher from yesterday’s close.

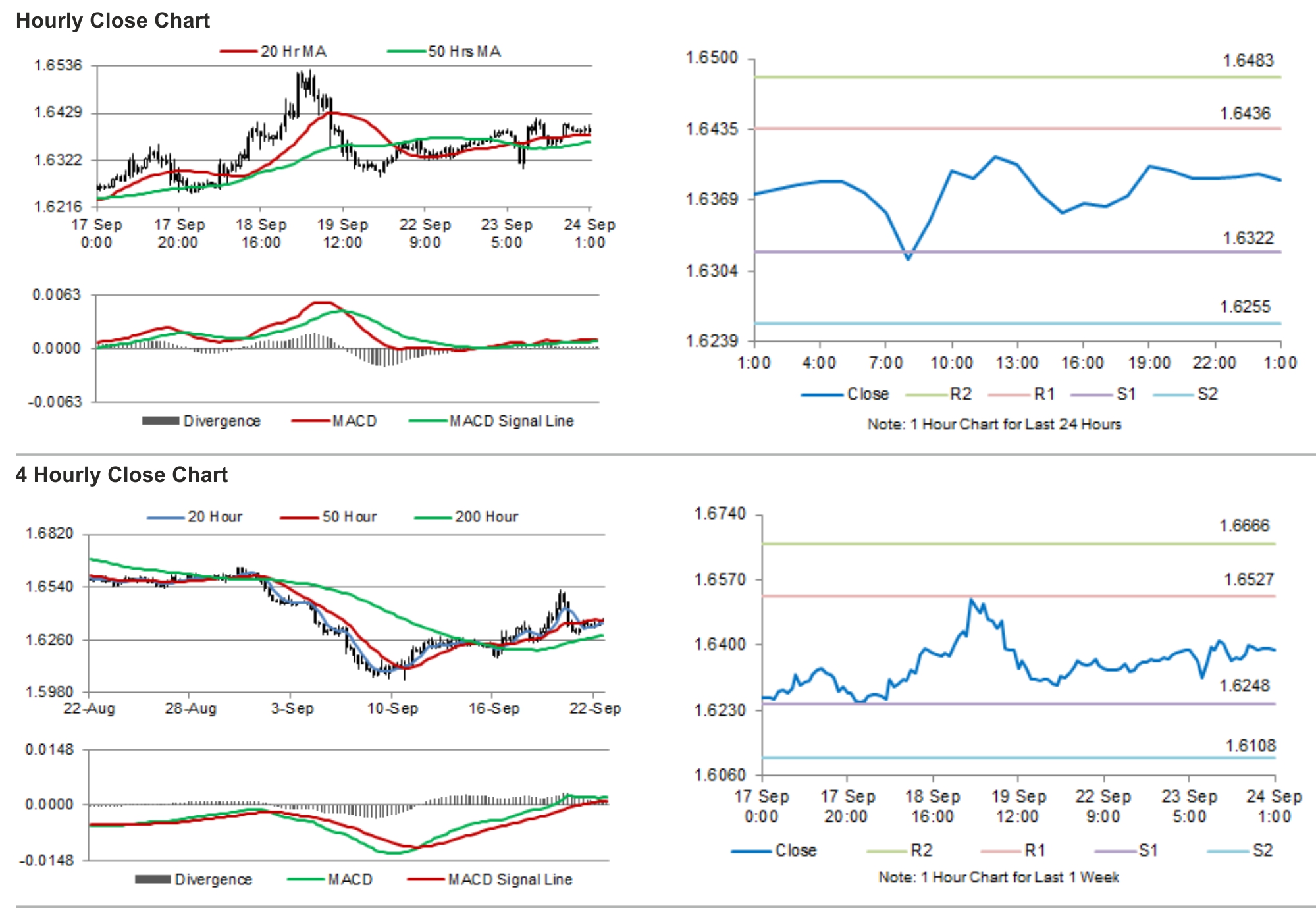

The pair is expected to find support at 1.633, and a fall through could take it to the next support level of 1.6259. The pair is expected to find its first resistance at 1.6444, and a rise through could take it to the next resistance level of 1.6487.

Trading trends in the Pound today are expected to be determined by economic news from other countries.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.