For the 24 hours to 23:00 GMT, the EUR declined 0.23% against the USD and closed at 1.2444, after the US recorded encouraging industrial as well as manufacturing data in November.

The greenback traded on a stronger footing, after industrial production in the US rose more than expected 1.3%, registering its biggest rise since May 2010 in November and up from previous month’s revised increase of 0.1%. Markets were expecting it to post a rise of 0.7%. Additionally, the nation’s manufacturing production advanced 1.1% in November, registering its largest increase in 9-months and exceeding market expectations for a 0.7% gain.

In other economic news, the NY Empire State manufacturing index registered an unexpected drop to -3.60, lower than market expectations of an advance to 12.0 and following a level of 10.16 in the previous month. Also, the nation’s NAHB housing market index surprisingly fell to 57.0 in December, lower than market expectations of an advance to 59.0.

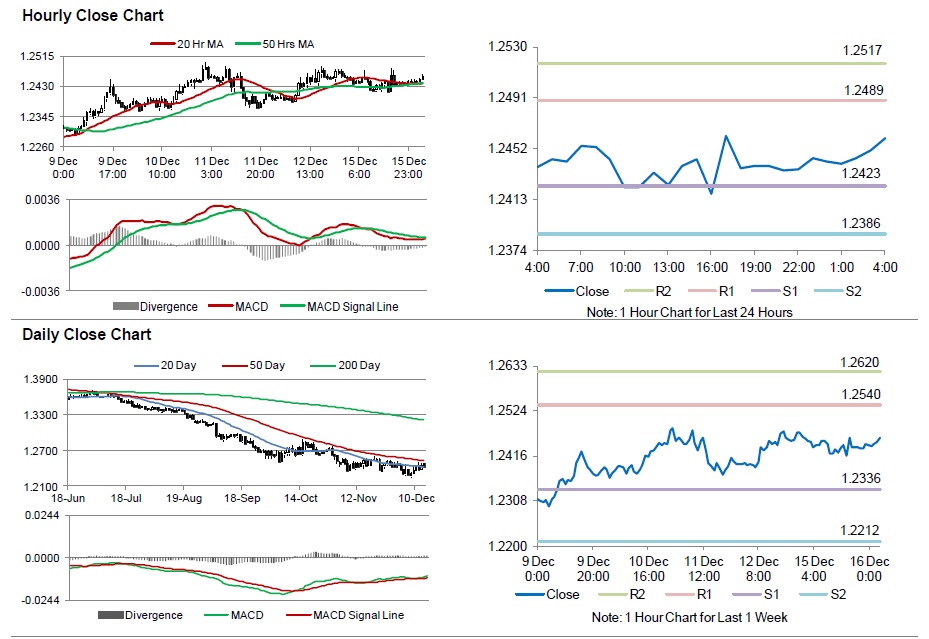

In the Asian session, at GMT0400, the pair is trading at 1.2460, with the EUR trading 0.13% higher from yesterday’s close.

The pair is expected to find support at 1.2423, and a fall through could take it to the next support level of 1.2386. The pair is expected to find its first resistance at 1.2489, and a rise through could take it to the next resistance level of 1.2517.

Trading trends in the Euro today are expected to be determined by the services and manufacturing PMI data from the Euro-zone and its peripheries, coupled with Germany’s ZEW economic sentiment data, scheduled in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.