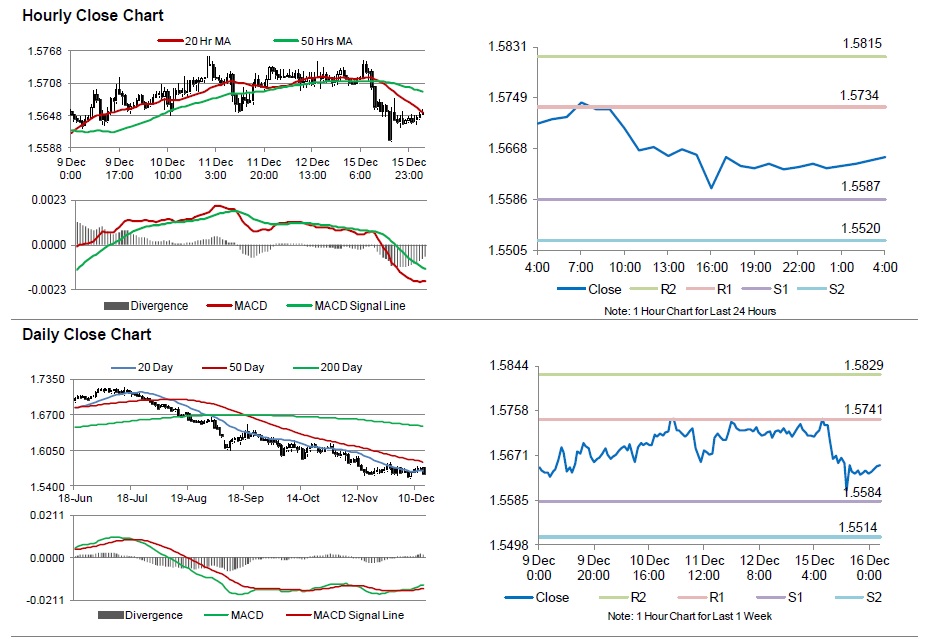

For the 24 hours to 23:00 GMT, the GBP fell 0.56% against the USD and closed at 1.5643.

On the macro front, the CBI trends selling prices in the UK recorded an unexpected rise to a level of 7.0 in December, compared to a reading of -1.0 in the previous month, while markets were anticipating it to drop to a level of -3.0.

Yesterday, the UK Chancellor George Osborne highlighted that the decline in oil prices was “overall a very good thing” for Britain, the US and Western economies.

In the Asian session, at GMT0400, the pair is trading at 1.5654, with the GBP trading 0.07% higher from yesterday’s close.

The pair is expected to find support at 1.5587, and a fall through could take it to the next support level of 1.5520. The pair is expected to find its first resistance at 1.5734, and a rise through could take it to the next resistance level of 1.5815.

Going forward, investors await the UK’s CPI data along with the nation’s bank stress test results, scheduled in a few hours.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.