For the 24 hours to 23:00 GMT, the EUR rose 0.18% against the USD and closed at 1.1292.

In macroeconomic front, the final print of the Euro-zone’s consumer price index fell by 0.1% on an annual basis after analysts expected the index to remain unchanged from its July’s level of 0.2%. Meanwhile, consumer price inflation on a monthly basis remained flat in August, at par with consensus estimates, compared to a drop of 0.6% in last month.

Yesterday, the Organization for Economic Cooperation and Development (OECD) cut its 2015 projections for global growth to 3.0% from 3.1% in June and its 2016 prediction from 3.8% to 3.6%, citing slowdown in China’s economy as well as recent turbulence in the global financial markets.

The greenback lost ground, after the US consumer price inflation dropped 0.1% MoM in August, from an increase of 0.1% registered in the previous month, thus casting shadow over the possibility of an interest rate hike in the nation by the Fed.

Other economic data showed that the NAHB housing price index unexpectedly advanced to a reading of 62.0 in September, following prior month’s level of 61.0.

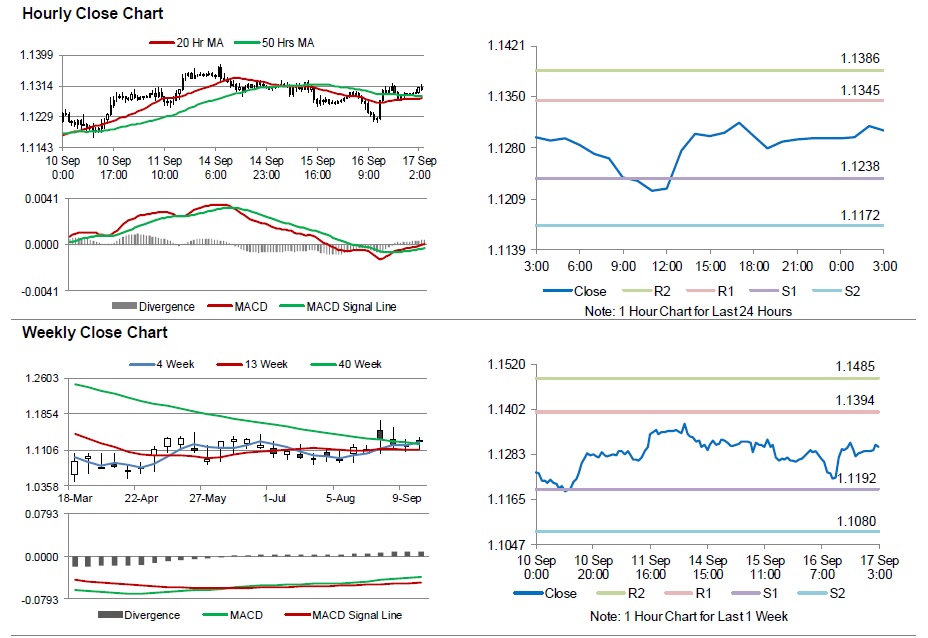

In the Asian session, at GMT0300, the pair is trading at 1.1303, with the EUR trading 0.1% higher from yesterday’s close.

The pair is expected to find support at 1.1238, and a fall through could take it to the next support level of 1.1172. The pair is expected to find its first resistance at 1.1345, and a rise through could take it to the next resistance level of 1.1386.

Trading trends in the pair today are expected to be determined by the Fed’s interest rate decision, scheduled later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.