For the 24 hours to 23:00 GMT, the GBP rose 0.99% against the USD and closed at 1.5498, after positive data from the UK labour market.

Data showed that unemployment rate in the nation for three months period ended July surprisingly fell to 5.5%, matching its lowest since 2008, from 5.6% in the preceding quarter. Additionally, wages grew at fastest pace in more than six years to 2.9% in the three-month period till July, compared with a rise of 2.6% in February to April period, showing an inflationary pressure building in the labour market.

Despite increasing global economic risks, the Bank of England Governor Mark Carney, in an annual report to parliament, suggested the possibility of hiking its key interest rate around the turn of the year. However, some of the other MPC members hinted that their voting for a move would be earlier.

In the Asian session, at GMT0300, the pair is trading at 1.5509, with the GBP trading 0.07% higher from yesterday’s close.

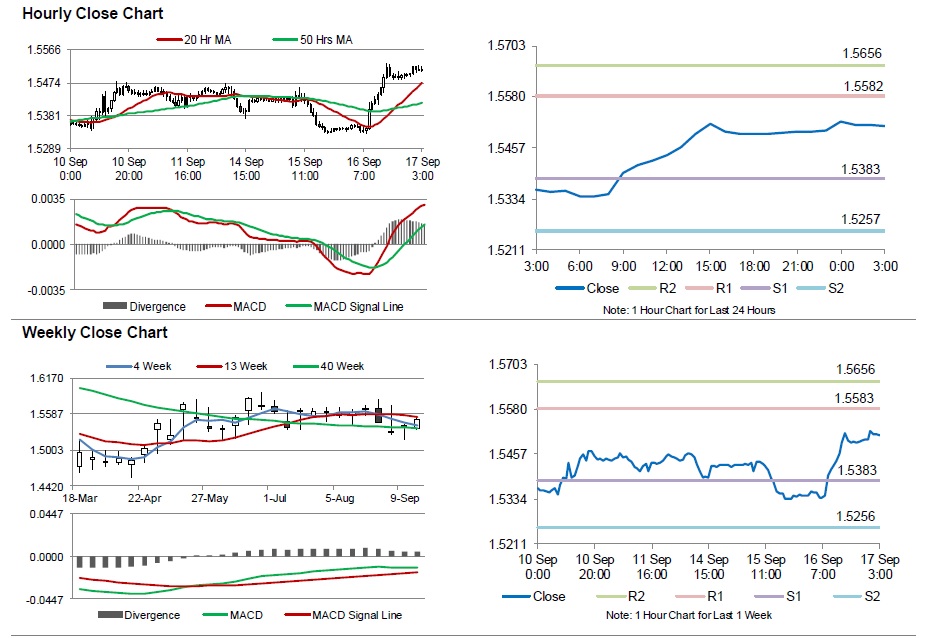

The pair is expected to find support at 1.5383, and a fall through could take it to the next support level of 1.5257. The pair is expected to find its first resistance at 1.5582, and a rise through could take it to the next resistance level of 1.5656.

Trading trends in the Pound today are expected to be determined by UK retail sales data for August, scheduled to release later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.