For the 24 hours to 23:00 GMT, the EUR declined 0.07% against the USD and closed at 1.1276, as uncertainty regarding Greek debt woes continued.

Yesterday, the preliminary estimate showed that Euro-zone’s economy grew 0.4% QoQ in the first three months of this year, compared to a similar growth posted a quarter ago.

Separately, the ECB’s governing council member, Jozef Makuch, opined that the ECB’s asset purchase program has had a positive impact on the European region, citing a pickup in inflation, weaker euro against the dollar and a fast paced recovery. Further, he added that the central bank’s bond buying and Targeted Longer-term Refinancing Operations (TLTRO) were stimulating economic activity in the European region.

The greenback traded on a stronger footing, on the back of upbeat JOLTs report.

Data showed that JOLTs job openings in the US advanced to 5.376 million in April, beating market estimate of an increase to 5.044 million and rising from previous month’s figure of 5.109 million. Moreover, the fresh figure was the highest since December 2000. Additionally, wholesale inventories in the nation advanced more than expected in April, following a revised rise of 0.2% in March.

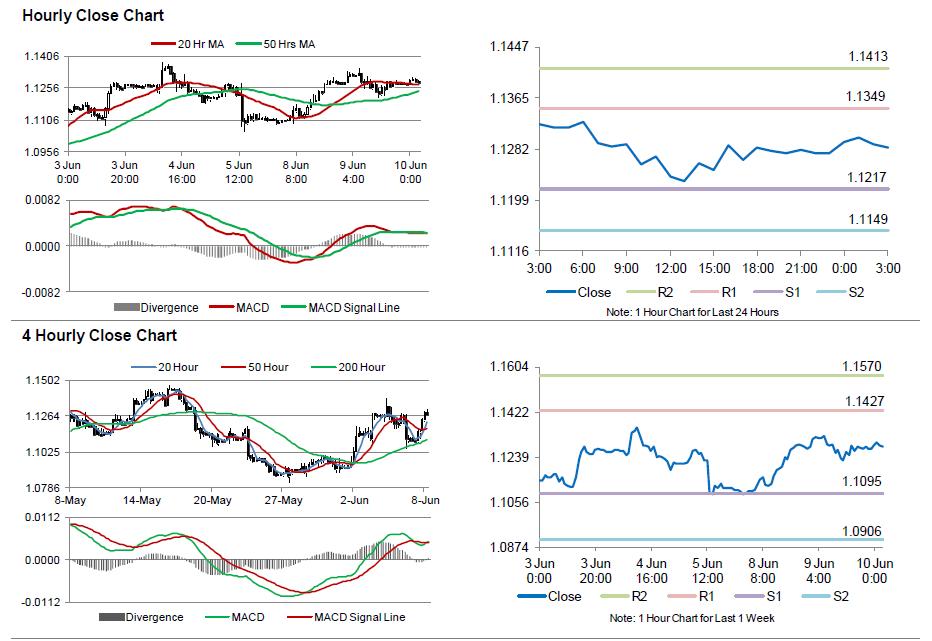

In the Asian session, at GMT0300, the pair is trading at 1.1284, with the EUR trading 0.07% higher from yesterday’s close.

The pair is expected to find support at 1.1217, and a fall through could take it to the next support level of 1.1149. The pair is expected to find its first resistance at 1.1349, and a rise through could take it to the next resistance level of 1.1413.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.