For the 24 hours to 23:00 GMT, the GBP rose 0.25% against the USD and closed at 1.5380, as Britain’s trade deficit improved.

Data showed that total trade deficit narrowed more than expected to £1.2 billion in April, down from a deficit of £3.1 billion in March. The improvement in the nation’s deficit raised hopes of a revival in exports which could finally provide a boost to the UK economy in the second quarter.

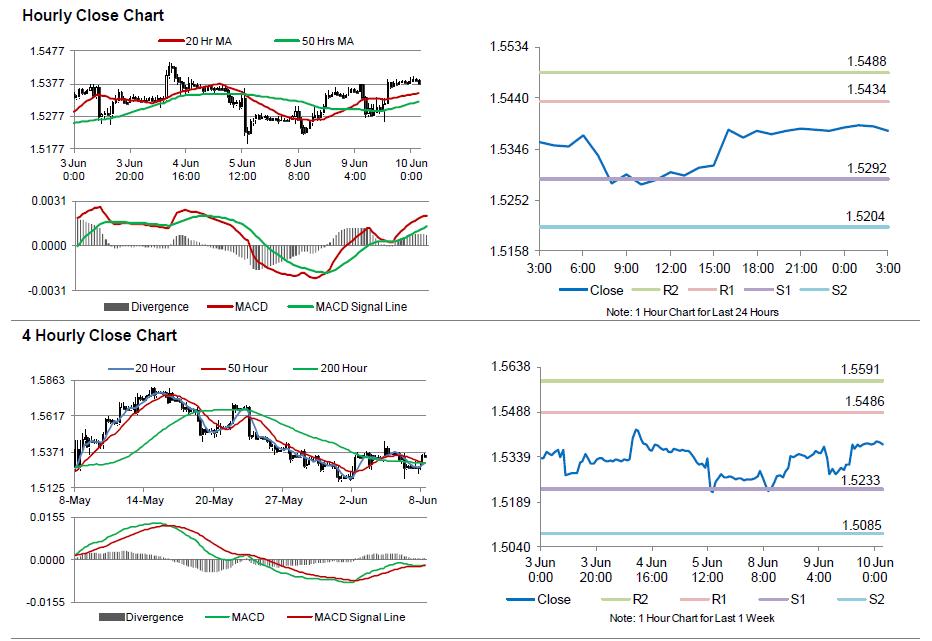

In the Asian session, at GMT0300, the pair is trading at 1.5380, with the GBP trading flat from yesterday’s close.

The pair is expected to find support at 1.5292, and a fall through could take it to the next support level of 1.5204. The pair is expected to find its first resistance at 1.5434, and a rise through could take it to the next resistance level of 1.5488.

Moving ahead, investors await key economic data which includes Britain’s industrial and manufacturing production data, scheduled in a few hours. Additionally, the NIESR GDP estimate, scheduled later today would grab lot of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.