For the 24 hours to 23:00 GMT, the EUR rose 0.13% against the USD and closed at 1.1220, after preliminary consumer prices in Germany rose more than expected 0.2% YoY in August.

Eurozone’s business climate indicator and the industrial confidence index dropped more than expected in August, while the consumer confidence index rose less than expected in August.

In the US, Michigan’s consumer sentiment fell more than expected in August from July.

Yesterday, Germany’s retail sales rebounded in July, rising 1.4% MoM, after a fall of 1.0% in the previous month.

In the US, the Chicago Fed PMI fell to a level of 54.40 in August, compared to a level of 54.70 in the previous month. The Dallas Fed manufacturing business index fell unexpectedly to a level of -15.80 in August, compared to a level of -4.60 in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.127, with the EUR trading 0.45% higher from yesterday’s close.

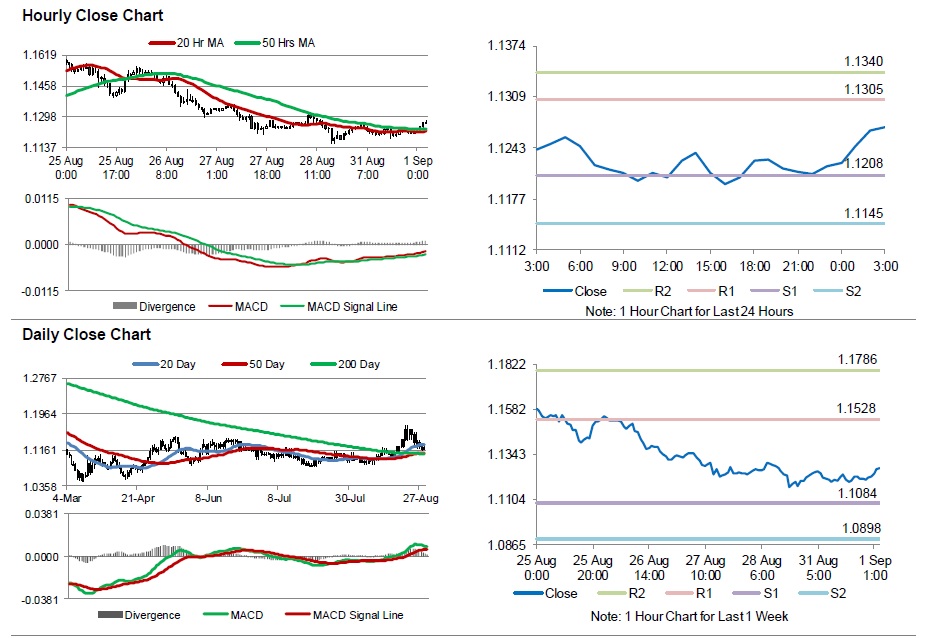

The pair is expected to find support at 1.1208, and a fall through could take it to the next support level of 1.1145. The pair is expected to find its first resistance at 1.1305, and a rise through could take it to the next resistance level of 1.1340.

Trading trends in the pair today are expected to be determined by unemployment rate of Eurozone as well as Germany.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.