For the 24 hours to 23:00 GMT, the GBP declined 0.43% against the USD and closed at 1.5351.

On Friday, the country’s economy grew in the second quarter, highlighting the 10th quarter of positive gains.

Over the weekend, BoE Governor Mark Carney, in a speech, opined that the probable timing of Britain’s rate hike should become clearer around early next year.

In the Asian session, at GMT0300, the pair is trading at 1.5402, with the GBP trading 0.33% higher from yesterday’s close.

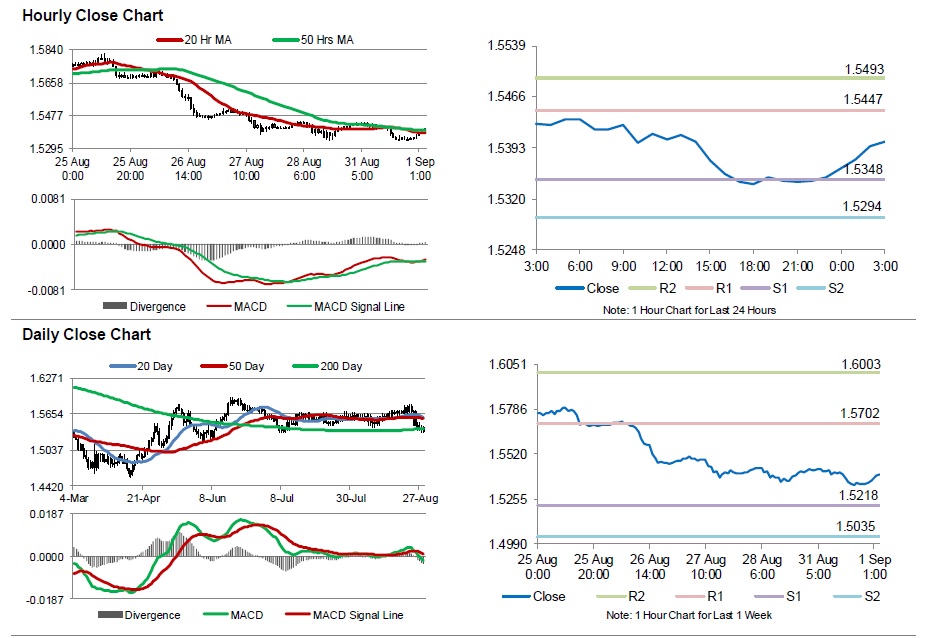

The pair is expected to find support at 1.5348, and a fall through could take it to the next support level of 1.5294. The pair is expected to find its first resistance at 1.5447, and a rise through could take it to the next resistance level of 1.5493.

Trading trends in the pair today are expected to be determined by July’s consumer credit and mortgage approvals data as well as manufacturing PMI figures of August.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.