For the 24 hours to 23:00 GMT, the EUR declined 0.46% against the USD and closed at 1.2171. The greenback traded on a stronger footing after the US 3Q GDP registered its strongest expansion in 11 years, thus raising speculations of a likely increase in the US interest rate by the Fed.

The greenback was further supported after the US consumer sentiment jumped to a level of 93.6 in December, beating market expectations of a drop to a reading of 93.5 and following a level of 93.8 recorded in November, indicating that the US consumers remained upbeat about the nation’s economy.

In other economic news, the US durable goods orders unexpectedly retreated 0.7% in November, compared to a 0.3% gain recorded in the preceding month. Market expectations were for it to rise 3.0%. Additionally, new home sales surprisingly dropped 1.6% on a MoM basis, marking a 4-month low level in November and confounding market expectations of a 0.4% increase. It had plunged 2.2% in the preceding month.

On the other hand, personal income in the US rose 0.4% in November, at par with market expectations, while personal spending advanced 0.6% in November, following a revised rise of 0.3% registered in the prior month.

Elsewhere, in France, the final GDP climbed 0.3% on a QoQ basis in 3Q 2014, compared to a fall of 0.1% in the previous quarter. Market anticipations were for it to rise 0.3%.

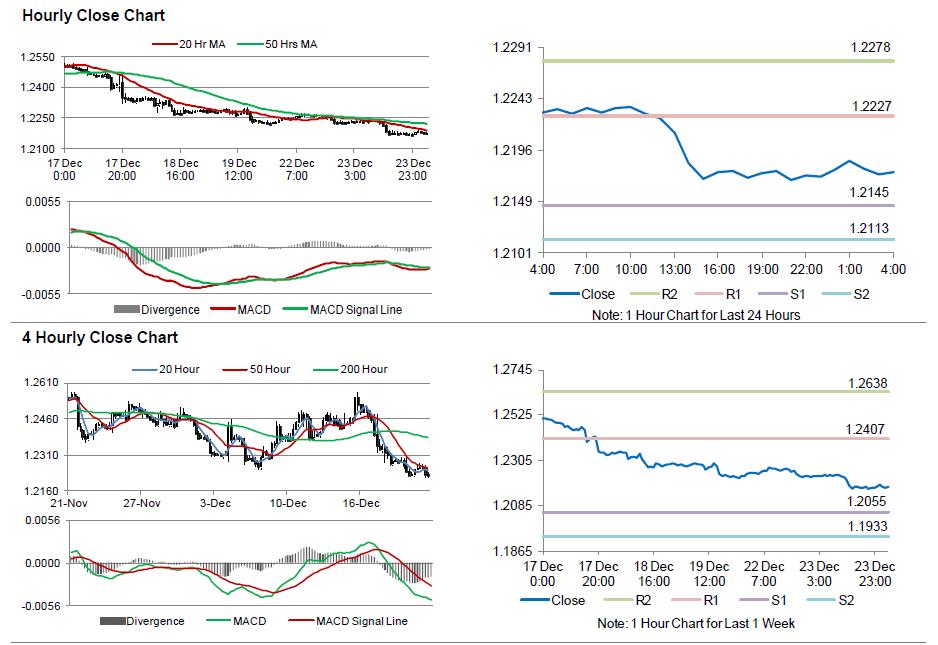

In the Asian session, at GMT0400, the pair is trading at 1.2176, with the EUR trading a tad higher from yesterday’s close.

The pair is expected to find support at 1.2145, and a fall through could take it to the next support level of 1.2113. The pair is expected to find its first resistance at 1.2227, and a rise through could take it to the next resistance level of 1.2278.

Trading trends in the pair today are expected to be determined by the US weekly initial jobless claims data, scheduled later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.