For the 24 hours to 23:00 GMT, the GBP fell 0.42% against the USD and closed at 1.5517, following downbeat economic releases from the UK.

The Pound came under pressure after Britain’s GDP rose less than expected 2.6% on a YoY basis in 3Q 2014 against market expectations for a 3.0% rise and compared to an expansion of 3.2% recorded in the prior quarter. Additionally, the nation’s current account deficit unexpectedly widened to £27.0 billion, following a deficit of £23.1 billion. Markets were expecting it to decrease to a level of £17.0 billion.

On the other hand, BBA mortgage approvals registered a drop to 36.72 K, higher than market expectations of a drop to 36.40 K. It had recorded a revised reading of 37.15 K in the prior month, thus highlighting a slowdown in British housing market.

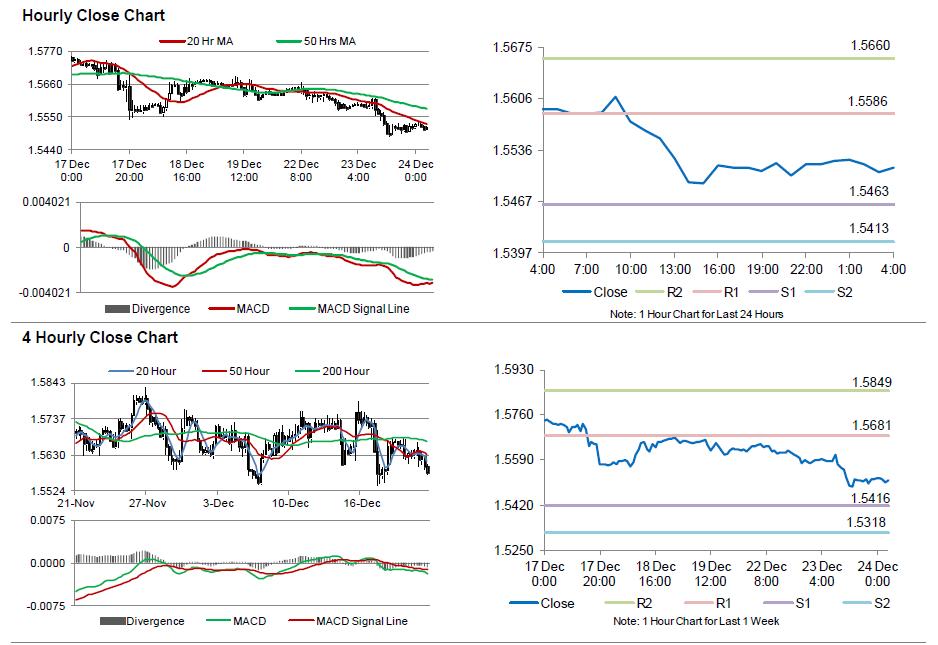

In the Asian session, at GMT0400, the pair is trading at 1.5513, with the GBP trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.5463, and a fall through could take it to the next support level of 1.5413. The pair is expected to find its first resistance at 1.5586, and a rise through could take it to the next resistance level of 1.5660.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.