For the 24 hours to 23:00 GMT, the EUR rose 0.10% against the USD and closed at 1.1095.

In the US, data showed that the Chicago Fed National Activity Index declined to a level of -0.35 in December, more than market anticipations for a fall to a level of -0.30 and compared to a revised level of 0.41 in the prior month. Additionally, the MBA mortgage applications dropped 1.2% on a weekly basis in the week ended 17 January 2020. In the previous week, mortgage applications had surged 30.2%. On the other hand, the housing price index rose 0.2% on a monthly basis in November, in line with market forecast and compared to a similar rise in the previous month. Further, existing home sales climbed 3.6% to a level of 5.54 million on monthly basis in December, surpassing market expectations. In the prior month, existing home sales had recorded a level of 5.35 million.

In the Asian session, at GMT0400, the pair is trading at 1.1082, with the EUR trading 0.12% lower against the USD from yesterday’s close.

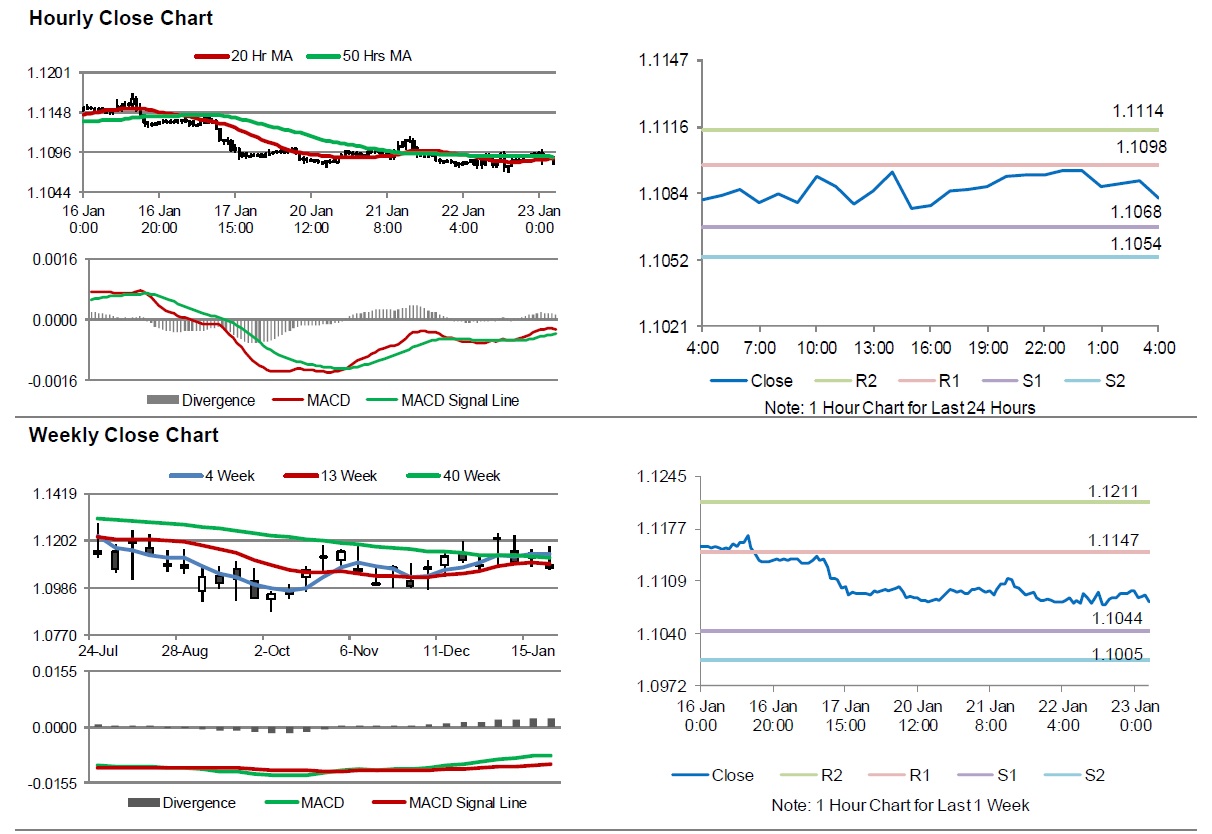

The pair is expected to find support at 1.1068, and a fall through could take it to the next support level of 1.1054. The pair is expected to find its first resistance at 1.1098, and a rise through could take it to the next resistance level of 1.1114.

Moving ahead, the European Central Bank’s (ECB) monetary policy meeting, due later in the day, will be closely watched for further hints on monetary policy as the central bank is widely expected to keep interest rates unchanged. Moreover, the US initial jobless claims data, set to release later today, will be on investors’ radar.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.