For the 24 hours to 23:00 GMT, the GBP rose 0.40% against the USD and closed at 1.3139.

In the UK, public sector net borrowing unexpectedly declined to £4.04 billion in December, compared to a revised reading of revised reading of £4.20 billion in the previous month. Moreover, the CBI industrial balance of firms reporting total order book above normal rose to a level of -22.00 in January, compared to a level of -28.00 in the prior month.

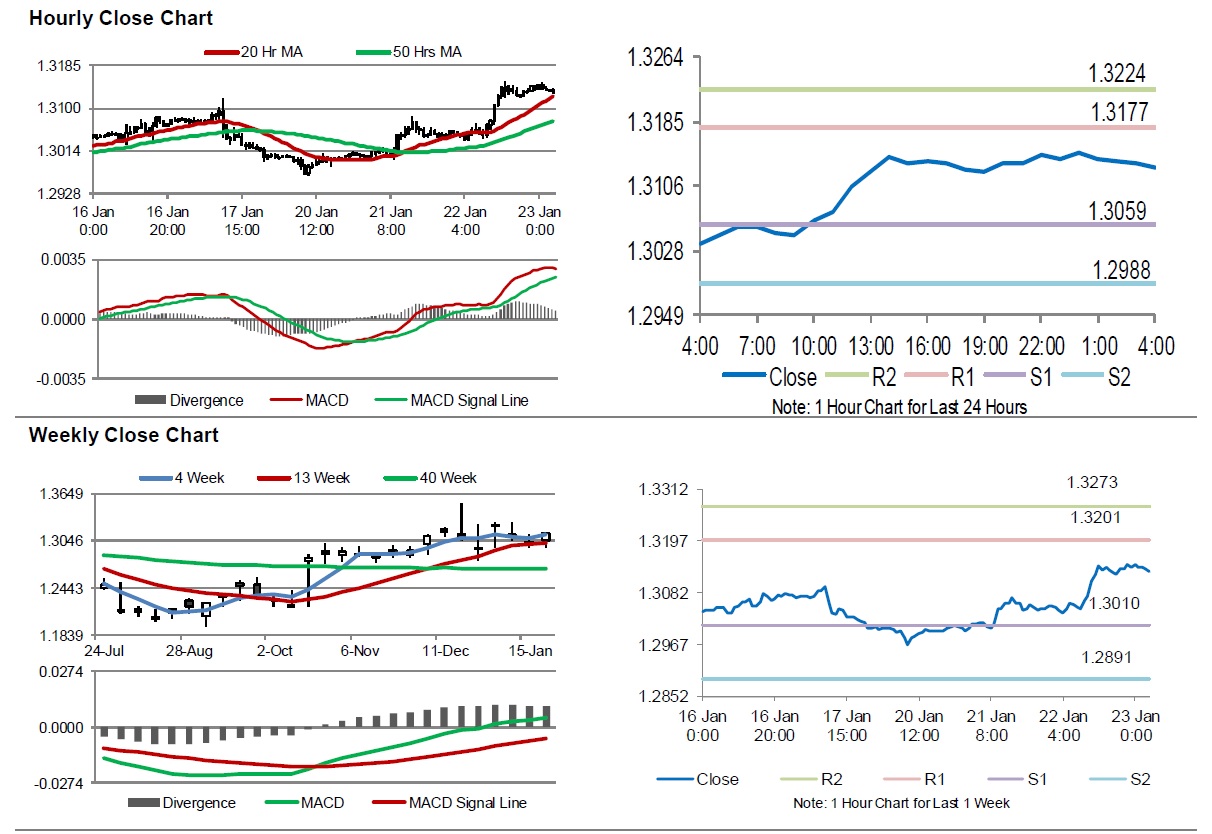

In the Asian session, at GMT0400, the pair is trading at 1.3130, with the GBP trading 0.07% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.3059, and a fall through could take it to the next support level of 1.2988. The pair is expected to find its first resistance at 1.3177, and a rise through could take it to the next resistance level of 1.3224.

Amid no major macroeconomic releases in the UK today, investor sentiment would be governed by global macroeconomic factors.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.