For the 24 hours to 23:00 GMT, the EUR rose 0.53% against the USD and closed at 1.0985.

Macroeconomic data showed that Germany’s unemployment rate remained unchanged at 6.4% in October, as expected. Additionally, the nation’s consumer price index remained flat MoM in October, defying forecasts for a 0.1% fall, after recording a drop of 0.2% in the previous month.

In the Euro-zone, the final consumer confidence index declined to a level of 7.7 in October, at par with market expectations, after registering a reading of -7.1 in the previous month. The preliminary figures had also indicated a drop to -7.7. On the other hand, the Euro-zone business climate indicator unexpectedly rose to a level of 0.44 in October, compared to revised level of 0.36 in the prior month. Investors had expected it to slightly decline to a reading of 0.32.

The greenback lost ground after the US annualised GDP expanded at a significantly slower rate in the third quarter of 2015. The nation’s GDP advanced just 1.5% in 3Q 2015, after recording a rise of 3.9% in the previous quarter. In other economic news, the initial jobless claims inched up slightly to a reading of 260.0K in the week ended 24 October, from a level of 259.0K in the previous week, but remained near a four-decade low. Investors had expected it to advance to a level of 265.0K. Meanwhile, pending homes sales unexpectedly slipped 2.3% MoM in September, following prior month’s 1.4% drop.

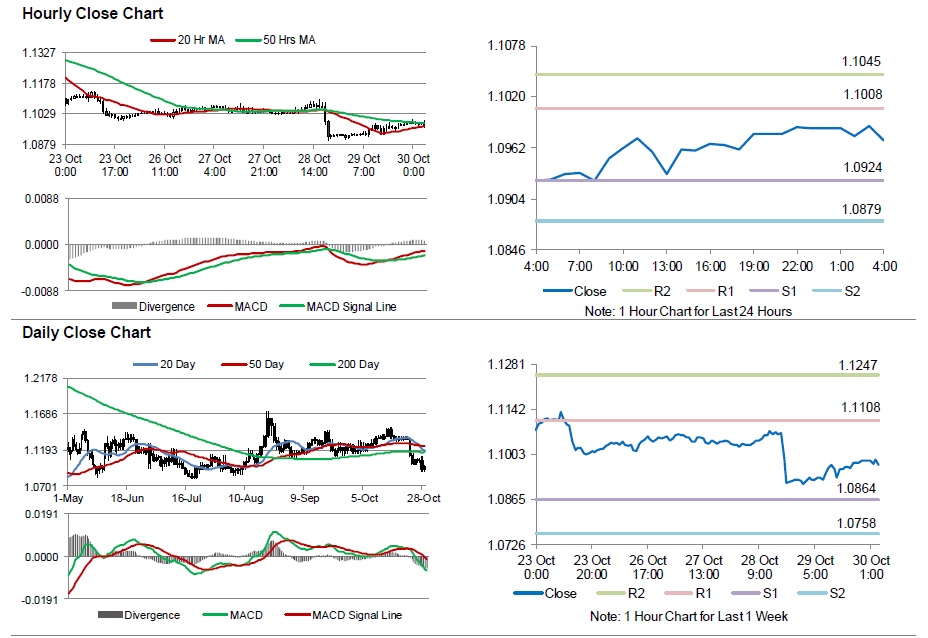

In the Asian session, at GMT0400, the pair is trading at 1.097, with the EUR trading 0.13% lower from yesterday’s close.

The pair is expected to find support at 1.0924, and a fall through could take it to the next support level of 1.0879. The pair is expected to find its first resistance at 1.1008, and a rise through could take it to the next resistance level of 1.1045.

Trading trends in the pair today are expected to be determined by the Euro-zone’s consumer price index and unemployment rate data, scheduled to be released in a few hours. Moreover, investors will also concentrate on the US personal spending, Chicago purchasing managers index and the Reuters/Michigan consumer sentiment index, scheduled to be released later today.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.