For the 24 hours to 23:00 GMT, the GBP rose 0.31% against the USD and closed at 1.5318.

In economic news, UK’s net consumer credit recorded a rise of £1.3 billion in September, compared to an upwardly revised similar level in the prior month. Investors had expected it to climb £1.1 billion. However, British mortgage approvals declined for the first time in four months to a level of 68.9K in September, compared to market expectations of a rise to a level of 72.5K. Number of mortgage approvals had registered a revised reading of 70.7K in the prior month.

In the Asian session, at GMT0400, the pair is trading at 1.5317, with the GBP trading marginally lower from yesterday’s close.

Overnight data showed that UK’s consumer confidence unexpectedly declined to a level of 2.0 in October, falling to its lowest level in four months and compared to a reading of 3.0 in the prior month. Investors were anticipating it to advance to a level of 4.0.

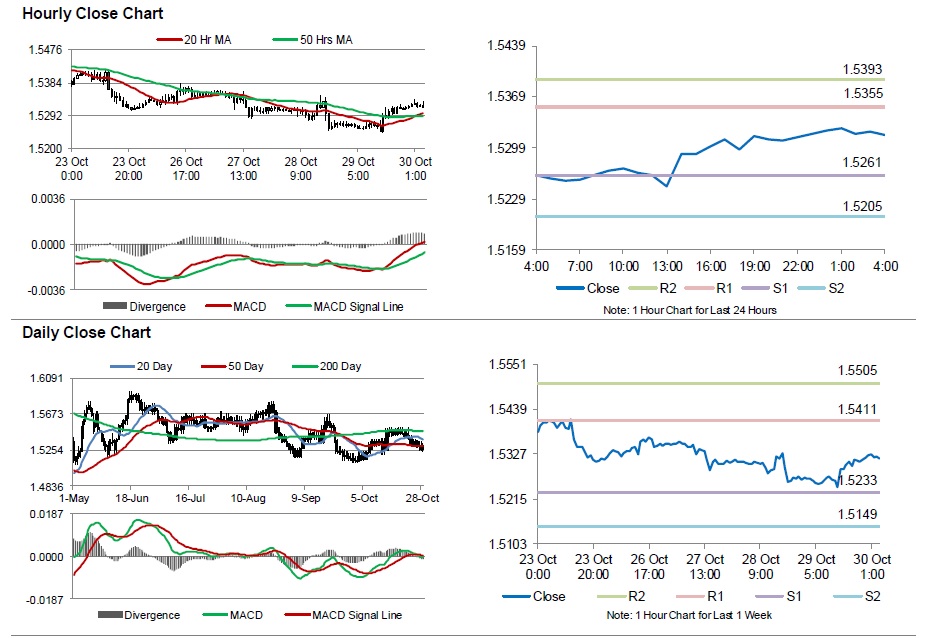

The pair is expected to find support at 1.5261, and a fall through could take it to the next support level of 1.5205. The pair is expected to find its first resistance at 1.5355, and a rise through could take it to the next resistance level of 1.5393.

Moving ahead, market participants will keep a close watch on BoE’s interest rate decision, scheduled to be announced later next week, after the UK economy slowed in 3Q 2015.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.