For the 24 hours to 23:00 GMT, the EUR marginally declined against the USD and closed at 1.3365, following uninspiring data from the Eurozone. Industrial production in the region unexpectedly fell in June and added to disappointment surrounding the region’s already struggling economy. Seasonally adjusted industrial production unexpectedly dropped 0.3%, on a monthly basis, compared to a fall of 1.1% in the prior month. Market expectations were for a rise of 0.4%. Meanwhile, German consumer inflation slumped to an annual 4-year low rate of 0.8% in July, in line with expectations, and compared to an advance of 1.0% in the previous month. Spain and France also reported consumer inflation numbers for July in line with market expectations, though a drop on a MoM basis raised fears of consolidating deflationary trends in the region. Additionally, German WPI dropped 0.7%, on an annual basis, compared to a drop of 0.8% in the previous month.

Yesterday, Bundesbank chief Jens Weidmann, in his interview to a French newspaper, said that the economic crisis has not ended in the Eurozone yet, however sees the inflation and growth to pick up gradually.

Meanwhile in the US, retail sales stagnated in July, marking it the weakest reading since January 2014, following a 0.2% increase, a month ago. Mortgage applications in the nation for the week to 8 August unexpectedly fell 2.7%, on an annual basis, compared a 1.6% rise in the previous week. On the other hand, business inventories in the US rose 0.4% in June, as expected, after it rose 0.5% in May.

Yesterday, the Boston Fed Chief, Eric S. Rosengren, in a speech, said that brokerage rules in the US have to be re-examined as banks who own broker dealers need to maintain sufficient capital in order to sustain any shock. Elsewhere, New York Fed President William Dudley, cited risks in the US wholesale market and opined that it would be difficult for the central bank to intervene in the market in case of a loss in investor confidence.

In the Asian session, at GMT0300, the pair is trading at 1.3359, with the EUR trading tad lower from yesterday’s close.

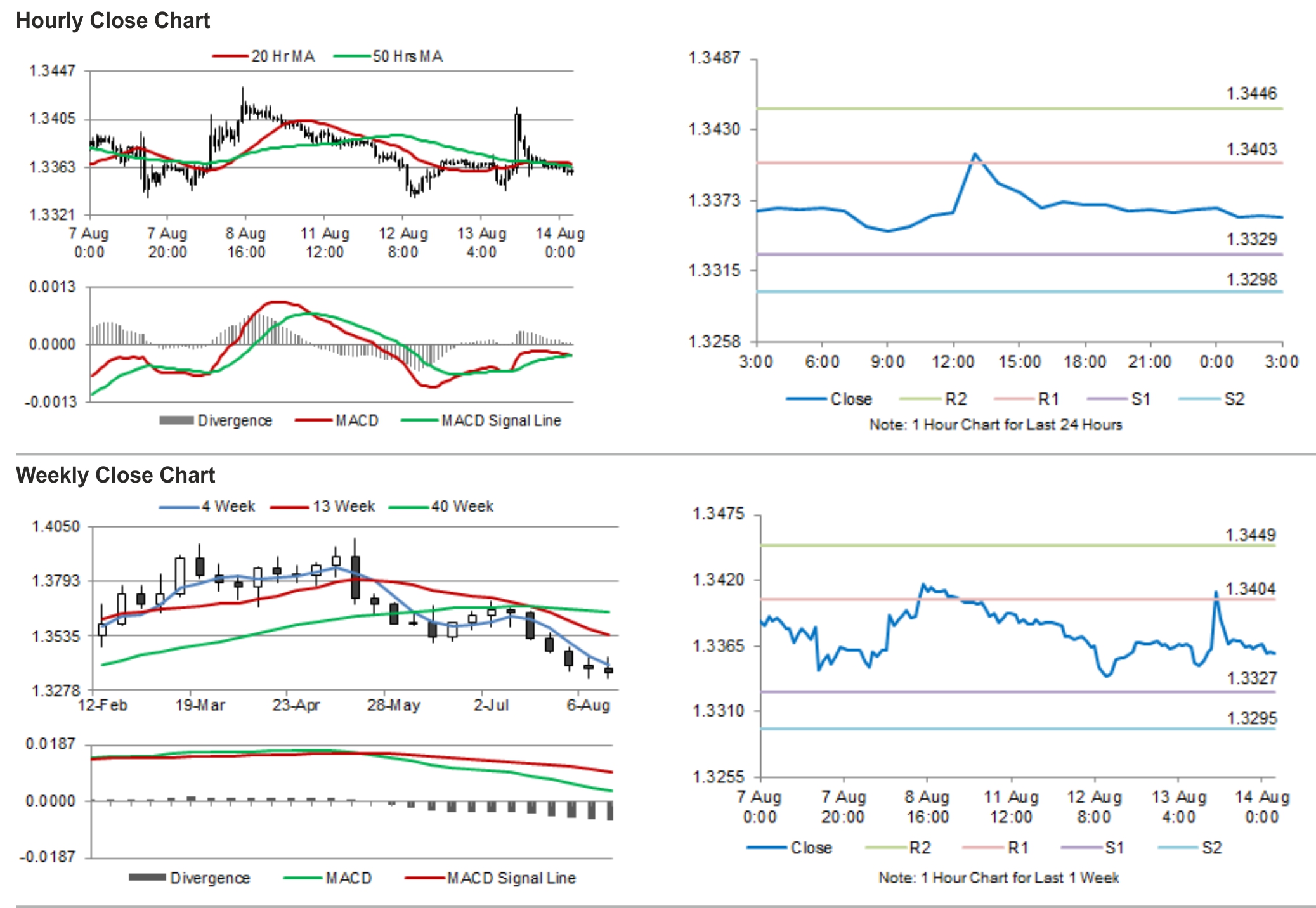

The pair is expected to find support at 1.3329, and a fall through could take it to the next support level of 1.3298. The pair is expected to find its first resistance at 1.3403, and a rise through could take it to the next resistance level of 1.3446.

Trading trends in the Euro today would be determined by the much important Eurozone’s GDP and consumer prices data as well as the ECB’s report.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.