For the 24 hours to 23:00 GMT, the GBP weakened 0.72% against the USD and closed at 1.6689, after the Bank of England (BoE) Governor, Mark Carney, in its August inflation report, he won’t rush to raise interest rates; citing rise in global geopolitical risks and weakness in wage growth.

The BoE now predicts an annual wage growth in Q4 at about 1.25%, down from 2.5% forecasted in May. The bank also cut its estimate for the current medium-term equilibrium unemployment rate to around 5.5%, down from its previous estimate of about 6.25%. Meanwhile, the BoE now sees that the economy will grow 0.7% this quarter, and also raised its 2014 forecast to 3.5%, from 3.4% estimated earlier.

In economic news, the average earnings including bonus dropped 0.2%, on an annual basis in the second quarter, its first decline since 2009, compared to market expectations of a fall of 0.1%. Meanwhile, the claimant count dropped for the 21st month in a row, registering a fall of 33.6 K in July, higher than market expectations, and follows a 39.5 K drop in June. Elsewhere, the unemployment rate eased to 6.4% in June, in line with consensus estimates, down from a previous level of 6.5%.

In the Asian session, at GMT0300, the pair is trading at 1.6679, with the GBP trading 0.06% lower from yesterday’s close.

Earlier in the morning, the RICS reported that house price balance in the UK eased to 49.0 in July, compared to a reading of 52.0 in the previous month. Market anticipations for it were to fall to a level of 51.0.

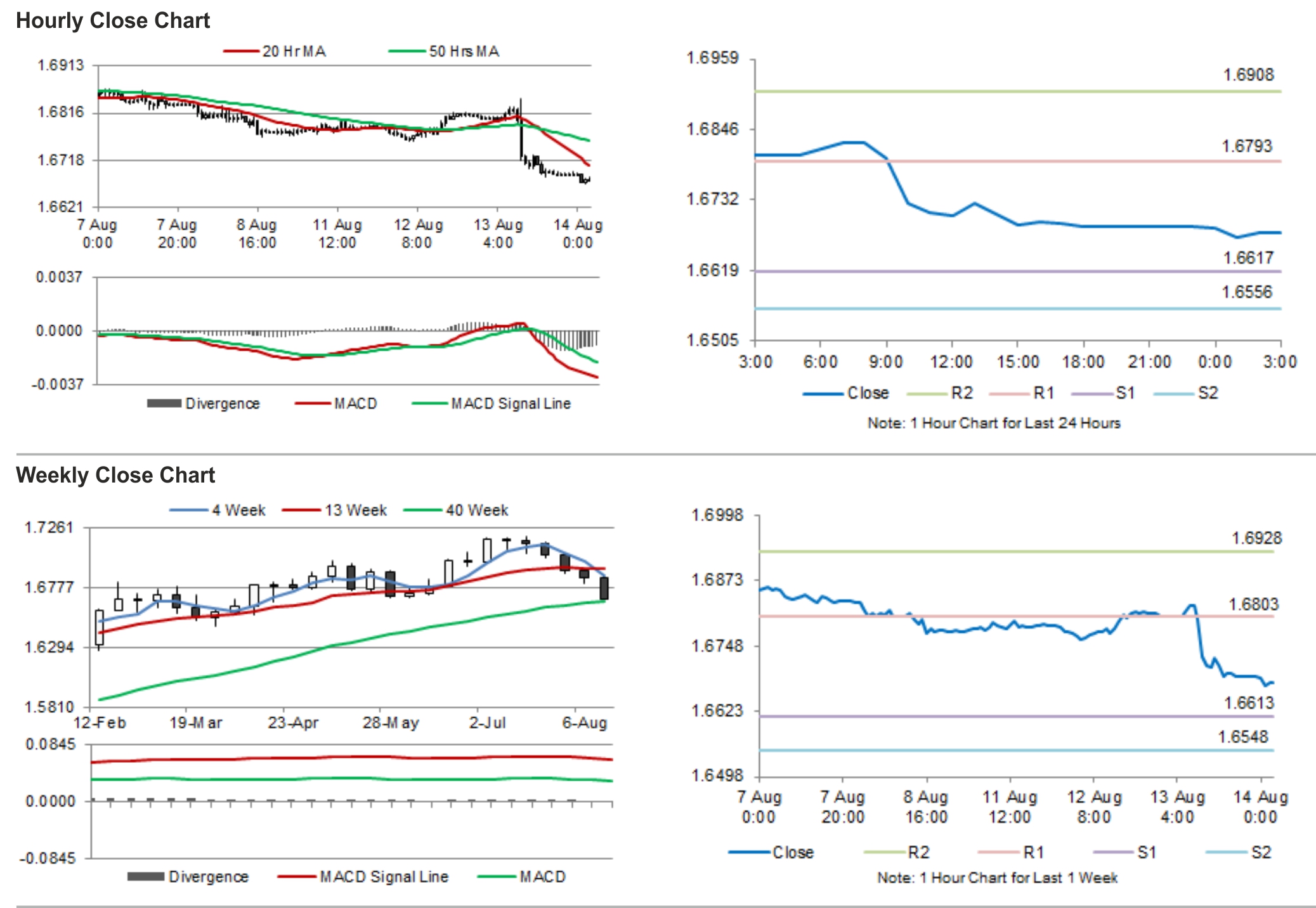

The pair is expected to find support at 1.6617, and a fall through could take it to the next support level of 1.6556. The pair is expected to find its first resistance at 1.6793, and a rise through could take it to the next resistance level of 1.6908.

Amid lack of economic releases from the UK today, investor would shift their focus on Friday’s GDP numbers for the UK.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.