On Friday, the EUR declined 0.45% against the USD and closed at 1.3603. The US Dollar gained ground against the Euro after two of key Fed policy-makers highlighted the possibility for a further slow-down in the pace of the quantitative easing (QE) measures in the coming months. Philadelphia Fed President, Charles Plosser, hinted that the Fed could consider cutting its bond-buying by more than a $10 billion monthly increment in the future, while Richmond Fed President, Jeffrey Lacker, stated that he expected further reductions in the pace of purchases to be under consideration at upcoming meetings.

However, on Saturday, President of Boston Fed, Eric Rosengren, suggested that the Fed should not rush to cut its stimulus programme with inflation rate below 2%.

Meanwhile, on the economic front, the European Central Bank (ECB) reported that the M3 money supply growth in the region stood at 1.5% (YoY) in the month of November, in-line with market estimates and above previous month’s level of 1.4%.

In the Asian session, at GMT0400, the pair is trading at 1.3582, with the EUR trading 0.15% lower from Friday’s close.

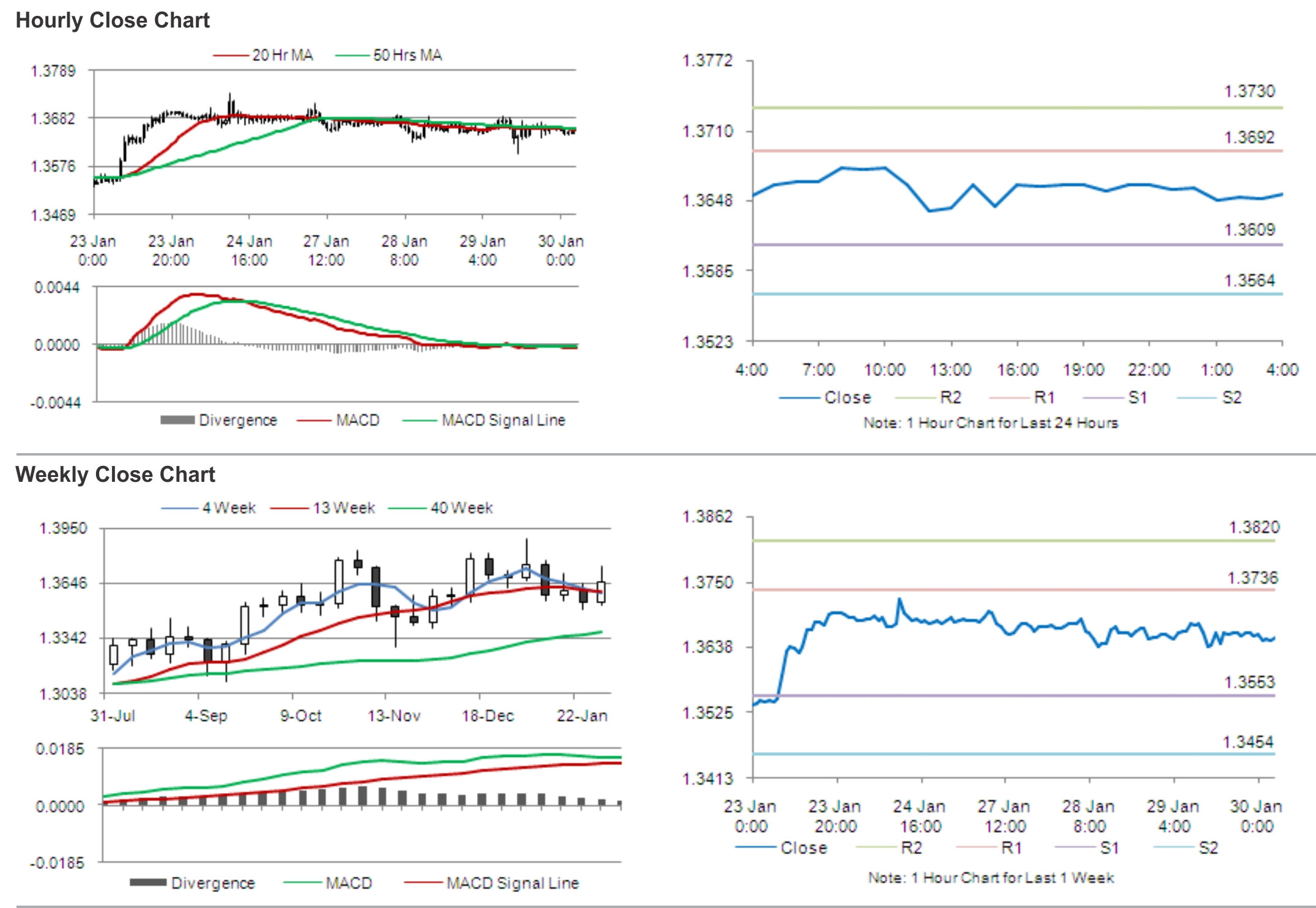

The pair is expected to find support at 1.3551, and a fall through could take it to the next support level of 1.3520. The pair is expected to find its first resistance at 1.3640, and a rise through could take it to the next resistance level of 1.3698.

Traders keenly await the release of Euro-zone’s Markit service PMI data, composite PMI data and Sentix investor confidence data, slated for release later today. Market participants are also expected to keep a tab on the release of Germany’s consumer inflation, which is widely expected to rise to 1.4% (YoY) in December, from previous month’s level of 1.3%.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.