On Friday, GBP fell 0.13% against the USD and closed at 1.6427. The greenback advanced against its UK counterpart after two eminent Fed policy-makers supported further tapering in the pace of central bank’s stimulus measure in the near future.

In economic news, the PMI for UK’s construction sector declined less-than-expected to a reading of 62.1 in December, from previous month’s level of 62.6. Meanwhile, on a non-seasonally adjusted basis, UK’s nationwide housing prices rose 8.4% (YoY) in December, surpassing analysts’ estimate for a rise of 7.1% (YoY) and compared to a 6.5% increase registered in November. Separately, the Bank of England (BoE) reported that mortgage approvals in the nation rose more than market estimates, to a level of 70,758 in November, from a level of 68,029 recorded in the preceding month. However, consumer credit in the nation failed to meet market expectations by registering a rise of £0.627 billion in November, compared to the consensus for a rise of £0.700 billion.

In the Asian session, at GMT0400, the pair is trading at 1.6357, with the GBP trading 0.43% lower from Friday’s close.

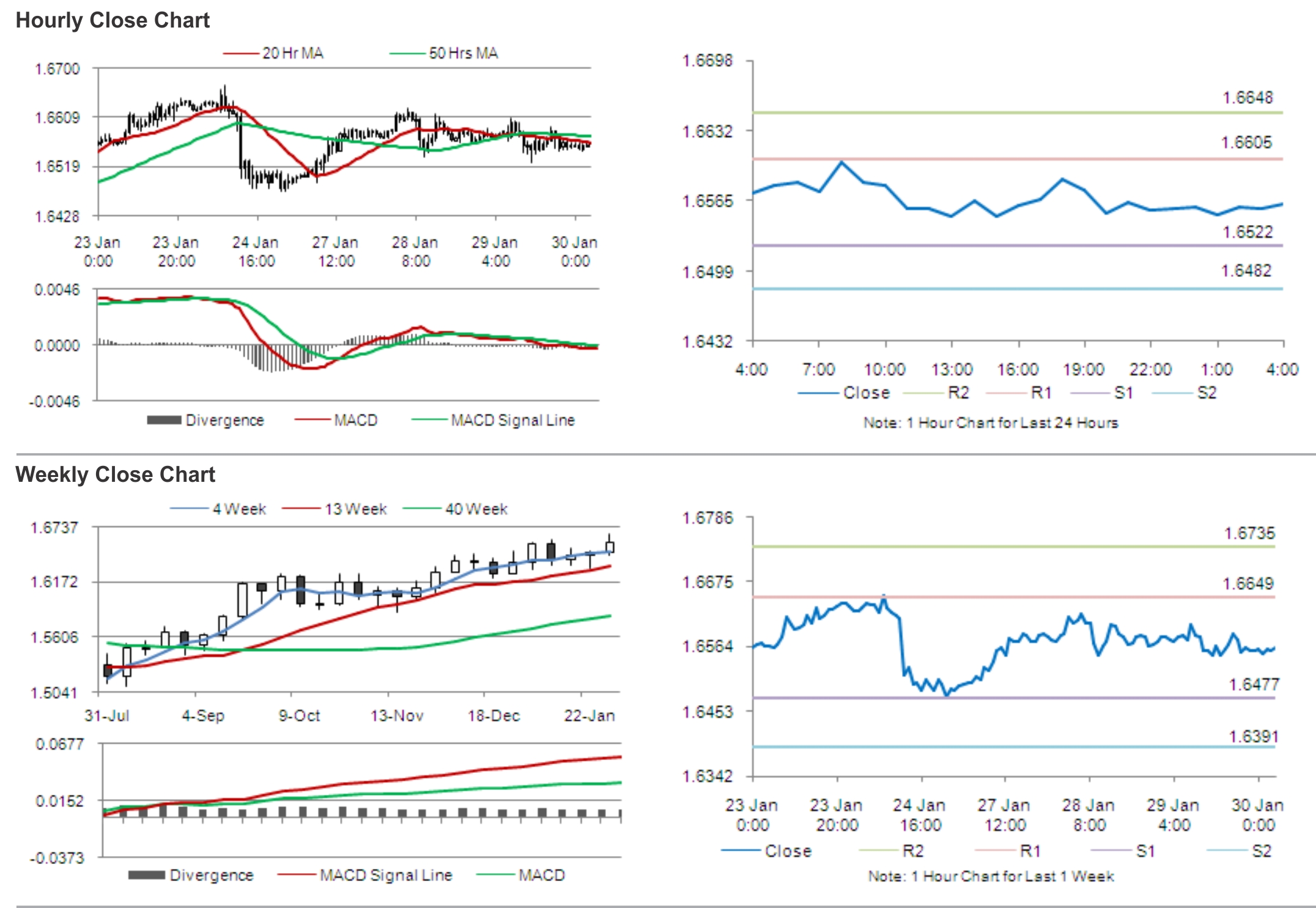

The pair is expected to find support at 1.6311, and a fall through could take it to the next support level of 1.6266. The pair is expected to find its first resistance at 1.6439, and a rise through could take it to the next resistance level of 1.6522.

Later today, Markit Economics is scheduled to release a report on UK’s service sector PMI.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.