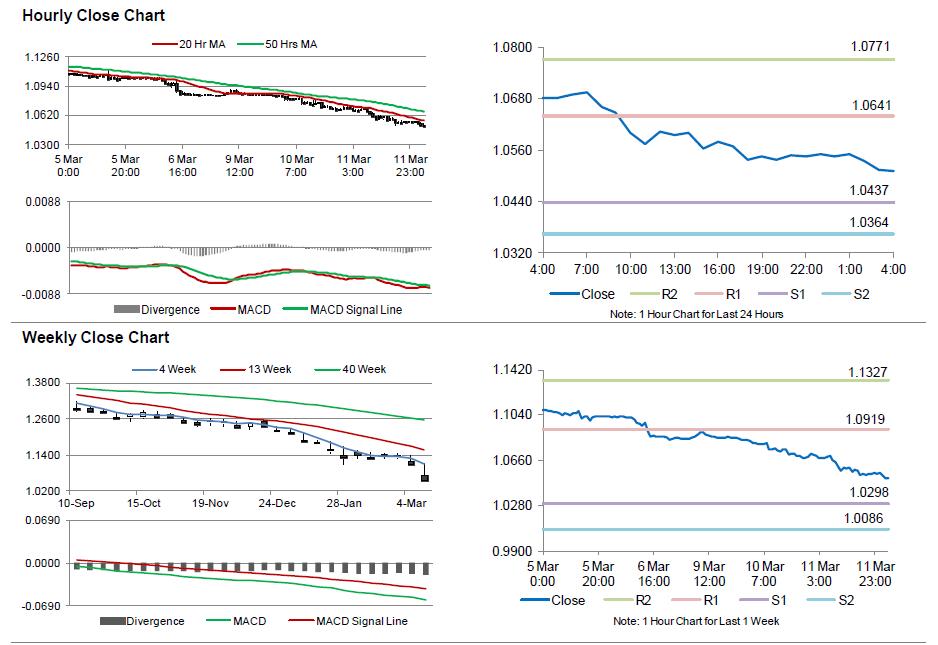

For the 24 hours to 23:00 GMT, the EUR declined 1.30% against the USD and closed at 1.0551.

Yesterday, the ECB President, Mario Draghi remained optimistic about the economic revival in the Euro-economy and backed the central bank’s decision of launching the massive programme of quantitative easing, which started two days back. He also assured that the asset purchase program will protect the Euro-zone countries from the Greek crisis.

In the US, mortgage applications registered a drop of 1.30% on a weekly basis in the week ended 06 March 2015. It had advanced 0.10% in the prior week.

In the Asian session, at GMT0400, the pair is trading at 1.0510, with the EUR trading 0.38% lower from yesterday’s close.

The pair is expected to find support at 1.0437, and a fall through could take it to the next support level of 1.0364. The pair is expected to find its first resistance at 1.0641, and a rise through could take it to the next resistance level of 1.0771.

Trading trends in the Euro today are expected to be determined by Germany’s CPI data, scheduled in a few hours. Additionally, investors would keep a close eye on the US advance retail sales data, scheduled later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.