For the 24 hours to 23:00 GMT, the GBP fell 0.89% against the USD and closed at 1.4935, following dismal industrial as well as manufacturing production data in the UK.

Industrial production in Britain unexpectedly slid 0.1% on a monthly basis in January, compared to market expectations of a 0.2% gain. It had dropped 0.2% in the previous month. Additionally, the nation’s manufacturing production contracted 0.5% MoM in January, reversing market forecasts of an advance of 0.2% and following a rise of 0.1% recorded in December, thus denting investor optimism over UK’s economic outlook.

Yesterday, leading think tanker NIESR estimated that Britain’s GDP expanded 0.6% in the December-February 2015 period.

Separately, the BoE’s monetary policy committee (MPC) member, Martin Weale stated that the central bank might need to raise interest rates in the UK sooner than anticipated, amid low oil prices and a robust pace of growth in domestic wages.

In the Asian session, at GMT0400, the pair is trading at 1.4926, with the GBP trading 0.06% lower from yesterday’s close.

Earlier today, the RICS house price balance in the UK unexpectedly advanced to 14.0 in February, following a reading of 7.0 in the prior month. Market anticipations were for house price balance to ease to a level of 6.0.

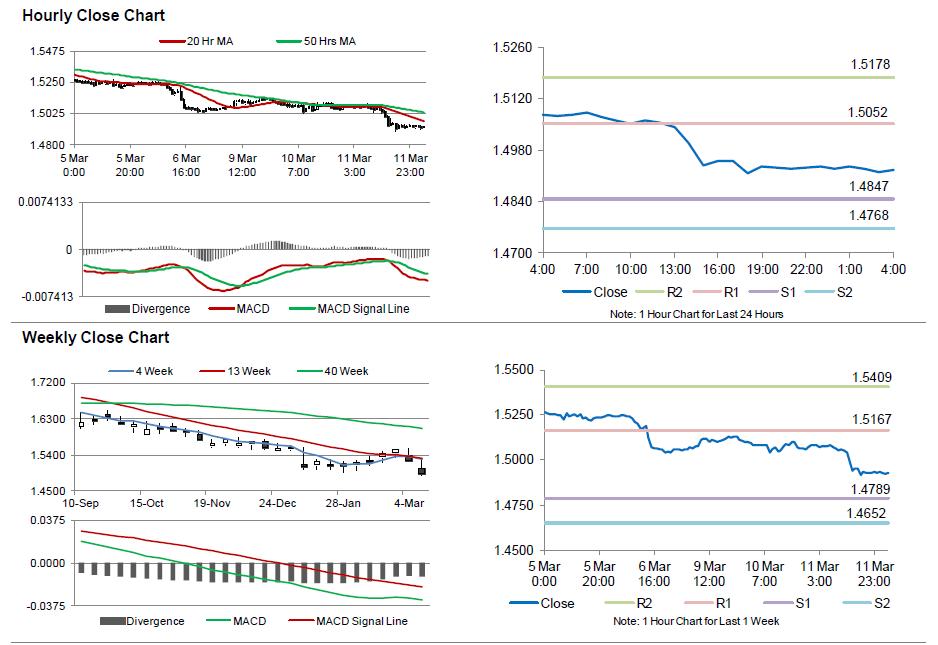

The pair is expected to find support at 1.4847, and a fall through could take it to the next support level of 1.4768. The pair is expected to find its first resistance at 1.5052, and a rise through could take it to the next resistance level of 1.5178.

Going forward, investors await the release of Britain’s total trade balance data, scheduled in a few hours. Additionally, the BoE Governor, Mark Carney’s speech, scheduled later today would be closely monitored by the market participants.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.