On Friday, the EUR rose 0.09% against the USD and closed at 1.0892.

In economic news, Germany’s import price index rebounded 1.4% on a monthly basis in February, beating market expectations for an advance of 0.5% and following a 0.8% drop registered in the preceding month.

Separately, the Bundesbank Chief, Jens Weidmann, warned that debt level in the Euro-zone have entered the “danger zone” and added that he was not in favour of increasing emergency loans to Greece, as the new government has lost much trust with its creditors.

In the US, the Fed Chief, Janet Yellen mentioned that the US central bank would increase its key interest rates later this year and the hike would be gradual.

Data showed that the final annualized GDP expanded 2.2% in the final quarter of 2014, lower than market expected growth of 2.4% and compared to an expansion of 5.0% recorded in the preceding quarter. Other data showed that the nation’s final Reuters/Michigan consumer sentiment index eased to 93.0 in March, higher than market expectations of a drop to 92.0 and following a reading of 91.2. Meanwhile, the final personal consumption climbed 4.40% in 4Q 2014, compared to a rise of 4.20% in the prior quarter. Markets were anticipating personal consumption to advance 4.40%.

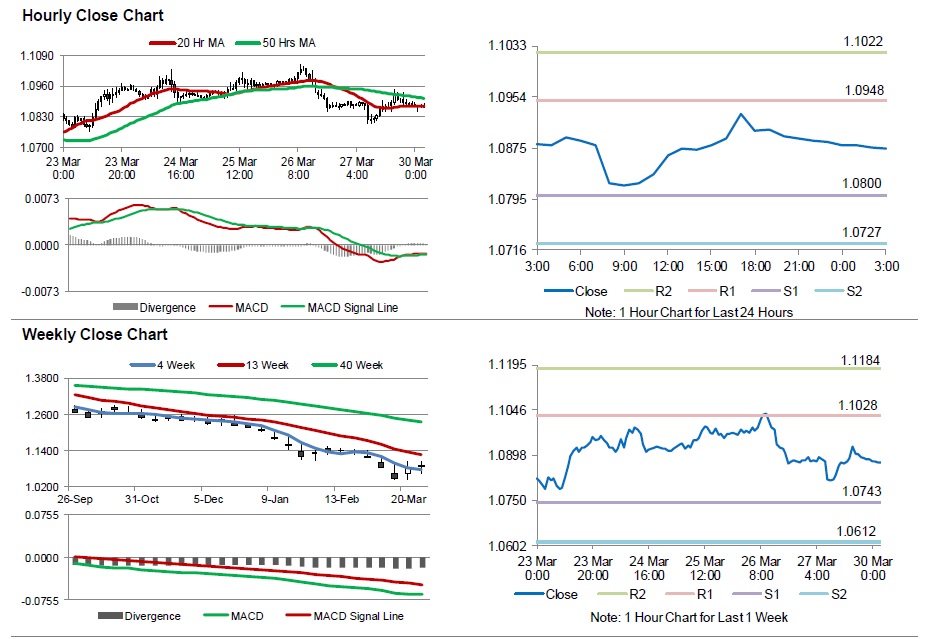

In the Asian session, at GMT0300, the pair is trading at 1.0873, with the EUR trading 0.17% lower from Friday’s close.

The pair is expected to find support at 1.0800, and a fall through could take it to the next support level of 1.0727. The pair is expected to find its first resistance at 1.0948, and a rise through could take it to the next resistance level of 1.1022.

Trading trends in the Euro today are expected to be determined by Germany’s preliminary CPI data, scheduled later today. Investors would also pay attention to the Euro-zone’s consumer confidence data, scheduled in few hours.

The currency pair is trading between its 20 Hr and 50 Hr moving average.