On Friday, GBP rose 0.09%against the USD and closed at 1.4866.

The BoE Governor, Mark Carney stated that the central bank was on track to increase interest rates in the UK, even though the nation was facing low inflation due to declining oil prices.

Separately, the BoE’s Deputy Governor, Ben Broadbent opined that the recent slowdown in annual inflation in the UK has been driven largely due to drop in oil prices. He further said that the risk of deflation was very low in the nation and expects consumer price inflation to rise “quite steeply” in early 2016.

In other economic news, Britain’s Nationwide house prices advanced 0.10% MoM in February, compared to a drop of 0.10% in the prior month. Market expectations were for house prices to climb 0.20%.

In the Asian session, at GMT0300, the pair is trading at 1.4867, with the GBP trading flat from Friday’s close.

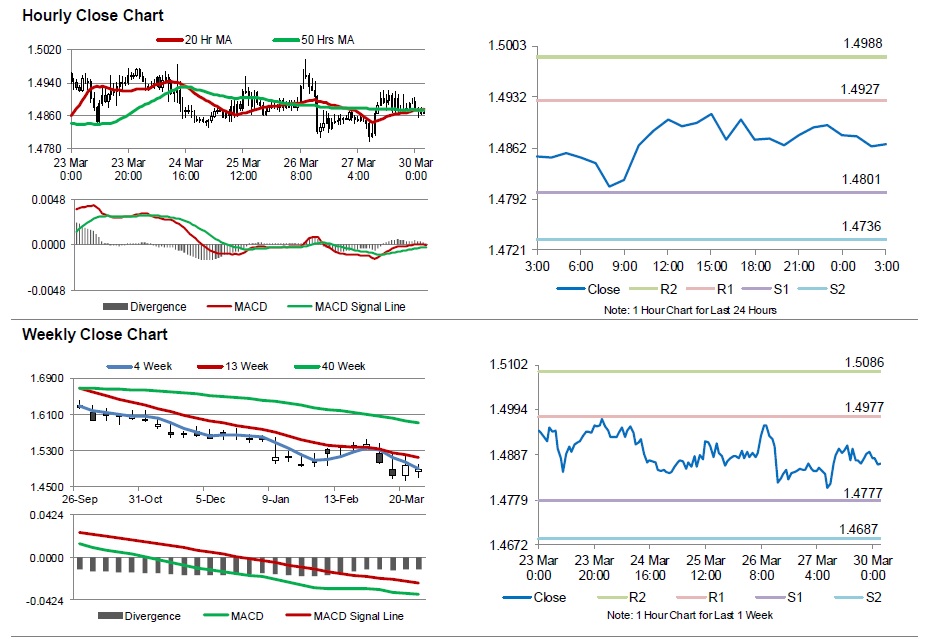

The pair is expected to find support at 1.4801, and a fall through could take it to the next support level of 1.4736. The pair is expected to find its first resistance at 1.4927, and a rise through could take it to the next resistance level of 1.4988.

Going forward, investor sentiment would be governed by Britain’s mortgage approvals data, scheduled in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.