For the 24 hours to 23:00 GMT, the EUR declined 0.11% against the USD and closed at 1.6073.

On the macro front, the wholesale price index (WPI) in Germany rose 0.1% on a monthly basis in September, at par with market expectations. It had registered a drop of 0.2% in August.

Separately, the ECB’s Executive Board Member, Peter Praet, opined that even though he sees no risk of deflation in the Euro-zone at present, but any new shock to the region’s economy could move the Euro-area towards deflation.

In the US, the Chicago Fed President, Charles Evans indicated that according to him he sees the first interest rate hike move by the Fed would be around early 2016, as inflation and continued slack in the labour market still exists in the economy. He further warned that any premature hike in interest rates could be the biggest and costliest downside risk to the US economy.

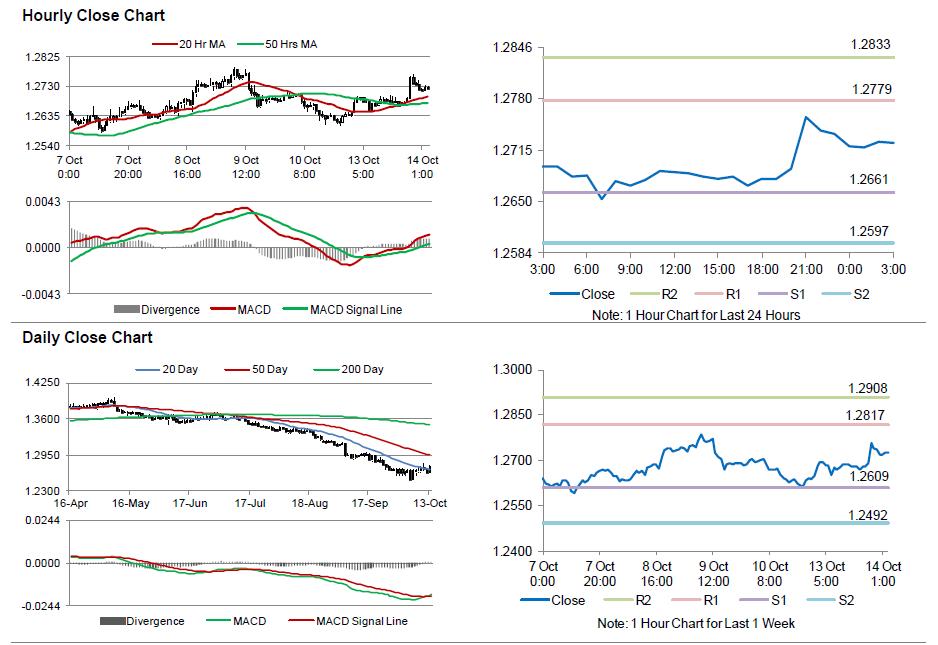

In the Asian session, at GMT0300, the pair is trading at 1.2725, with the EUR trading 0.09% lower from yesterday’s close.

The pair is expected to find support at 1.2661, and a fall through could take it to the next support level of 1.2597. The pair is expected to find its first resistance at 1.2779, and a rise through could take it to the next resistance level of 1.2833.

Going forward, investors await Germany’s ZEW economic sentiment data, scheduled in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.