For the 24 hours to 23:00 GMT, the GBP fell 0.11% against the USD and closed at 1.6073.

In economic news, the Lloyds employment confidence index in the UK jumped to a level of 10.0 in September, after registering a reading of 6.0 in August.

Separately, the BoE Governor, Mark Carney in an interview stated that global economic slowdown, lower inflation and sluggishness in the Euro-zone economy would have a significant effect on the central bank’s decision in its next month monetary policy meeting as to when it would raise its benchmark interest rates.

In the Asian session, at GMT0300, the pair is trading at 1.6073, with the GBP trading flat from yesterday’s close.

Overnight data from the British Retail Consortium indicated that the UK retail sales across all sectors unexpectedly dropped 2.1% on an annual basis in September, following a gain of 1.3% in August. Markets were expecting it to rise 1.0%.

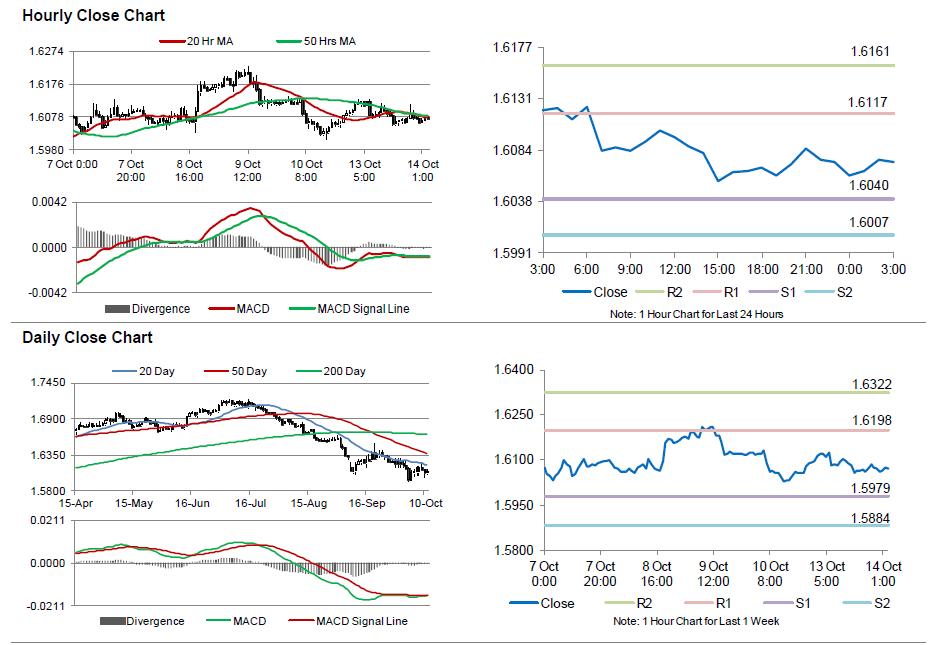

The pair is expected to find support at 1.6040, and a fall through could take it to the next support level of 1.6007. The pair is expected to find its first resistance at 1.6117, and a rise through could take it to the next resistance level of 1.6161.

Trading trends in the Pound today would be determined by the UK’s consumer price index (CPI) data, scheduled in a few hours.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.