For the 24 hours to 23:00 GMT, the EUR declined 0.20% against the USD and closed at 1.1193.

Yesterday, data showed that the Euro-zone’s final estimate of the services PMI came in at a level of 53.7 in September, from a reading of 54.0 in August. Moreover, the sentix investor confidence for the region declined to 11.7 in October, from 13.6 in the previous month, recording its weakest reading since February 2015, while retail sales remained flat MoM in August, following a 0.6% increase recorded in the preceding month.

Elsewhere, in Germany, the final seasonally adjusted Markit services PMI fell slightly to 54.1 points in September, from 54.3 in August. Further, the services sector activity index in Spain and Italy for the same month came in weaker-than-expected at 54.6 and 53.3, respectively. In contrast, the French Markit services PMI rose more-than-expected to a reading of 51.9 in September from prior month’s 51.2, backed by an increase in the flow of new orders.

Separately, at the first Eurogroup meeting, following the formation of the new Greek government, the Eurogroup President, Jeroen Dijsselbloem, stated that Greece should implement new pension and labour reforms, in order to obtain the release of €2.0 billion by mid-October.

In the US, data showed that Markit services PMI declined to a level of 55.1 in September, its lowest since June, compared to the flash estimate of 55.6 released last week. Meanwhile, the ISM non-manufacturing PMI fell more-than-expected to 56.9 in September, compared to 59.0 in the preceding month. Also, the labour market conditions index for the same month came in at 0.0.

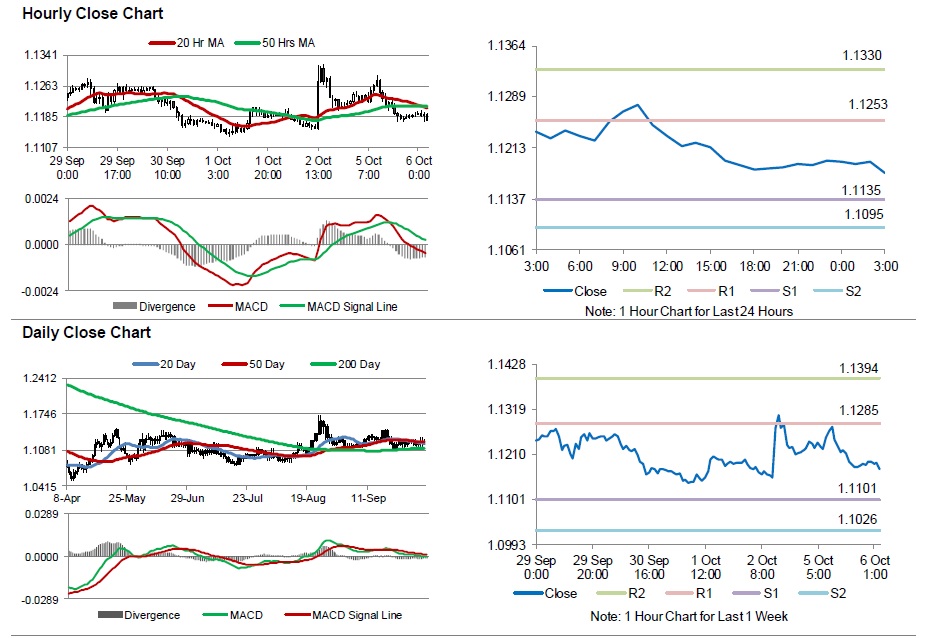

In the Asian session, at GMT0300, the pair is trading at 1.1175, with the EUR trading 0.16% lower from yesterday’s close.

The pair is expected to find support at 1.1135, and a fall through could take it to the next support level of 1.1095. The pair is expected to find its first resistance at 1.1253, and a rise through could take it to the next resistance level of 1.1330.

Going ahead, market participants will look forward to the release of Germany’s factory orders, data, scheduled today in a few hours. Additionally, the ECB President, Mario Draghi’s speech, scheduled later in the day would be closely watched by market participants. In addition to this, the US trade balance data, due later in the day, is also expected to attract investor attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.