For the 24 hours to 23:00 GMT, the GBP fell 0.24% against the USD and closed at 1.5147, after service activity in the UK slowed down in the third quarter, dampening optimism over the strength of the nation’s economy.

Data showed that the UK’s Markit services PMI fell to a two year low of 53.3 in September, from a level of 55.6 in the previous month, while markets expected the index to rise to 56.0.

In the Asian session, at GMT0300, the pair is trading at 1.5161, with the GBP trading marginally higher from yesterday’s close.

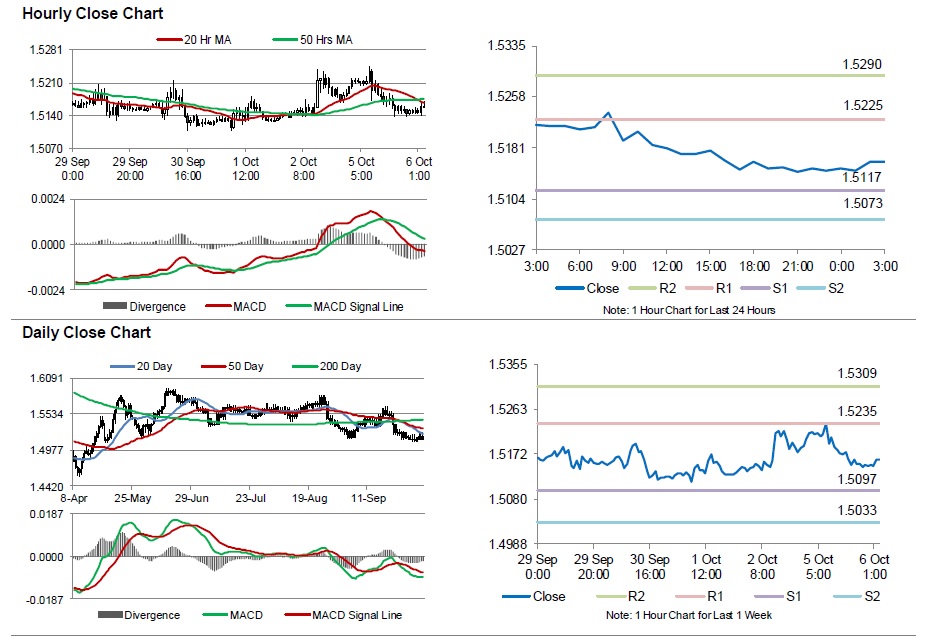

The pair is expected to find support at 1.5117, and a fall through could take it to the next support level of 1.5073. The pair is expected to find its first resistance at 1.5225, and a rise through could take it to the next resistance level of 1.5290.

Moving ahead, investors will concentrate on Britain’s industrial production, manufacturing production, and the NIESR GDP estimate data, scheduled to be released tomorrow, for further cues.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.