For the 24 hours to 23:00 GMT, the EUR declined marginally against the USD and closed at 1.1000.

In economic news, the French business sentiment index surprisingly dropped to a level of 98.0 in February, touching its weakest level since January 2013, compared to market expectations for it to remain steady at a reading of 101.0.

In the US, MBA mortgage applications rebounded 0.2% in the week ended 04 March 2016, following a drop of 4.8% in the previous week. Moreover, the nation’s wholesale inventories unexpectedly rose by 0.3% in January, compared to market expectations for a drop of 0.2%. In the previous month, wholesale inventories had registered a revised flat reading.

In the Asian session, at GMT0400, the pair is trading at 1.0974, with the EUR trading 0.24% lower from yesterday’s close.

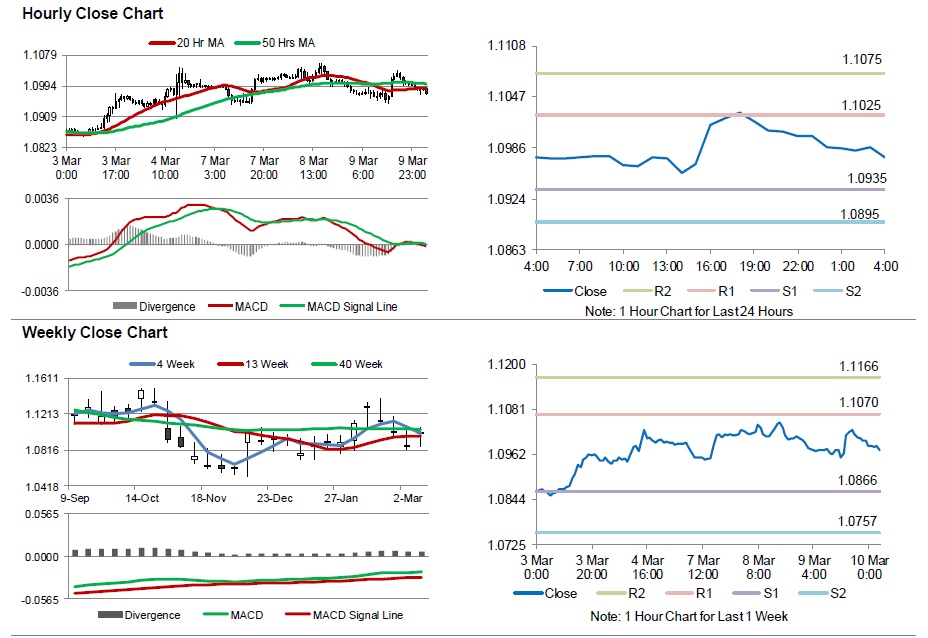

The pair is expected to find support at 1.0935, and a fall through could take it to the next support level of 1.0895. The pair is expected to find its first resistance at 1.1025, and a rise through could take it to the next resistance level of 1.1075.

Moving ahead, investors eagerly await the ECB’s interest rate decision, scheduled to be announced later in the day. Additionally, the US initial jobless claims data, due later today, will also attract market attention.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.