For the 24 hours to 23:00 GMT, the GBP rose marginally against the USD and closed at 1.4216, after data released in the UK painted a mixed picture of the nation’s economy.

Yesterday, data showed that Britain’s manufacturing production rebounded above expectations by 0.7% MoM in January, compared to market expectations for an advance of 0.2%, and after falling by a revised 0.3% in the previous month. On the other hand, the nation’s industrial production rose less-than-expected by 0.3% MoM in January, following a drop of 1.1% in the previous month. Investors had expected it to advance by 0.4%. Additionally, UK’s NIESR GDP estimate recorded a growth of 0.3% during the December-February 2016 period, down from 0.4% in the November-January 2016 period.

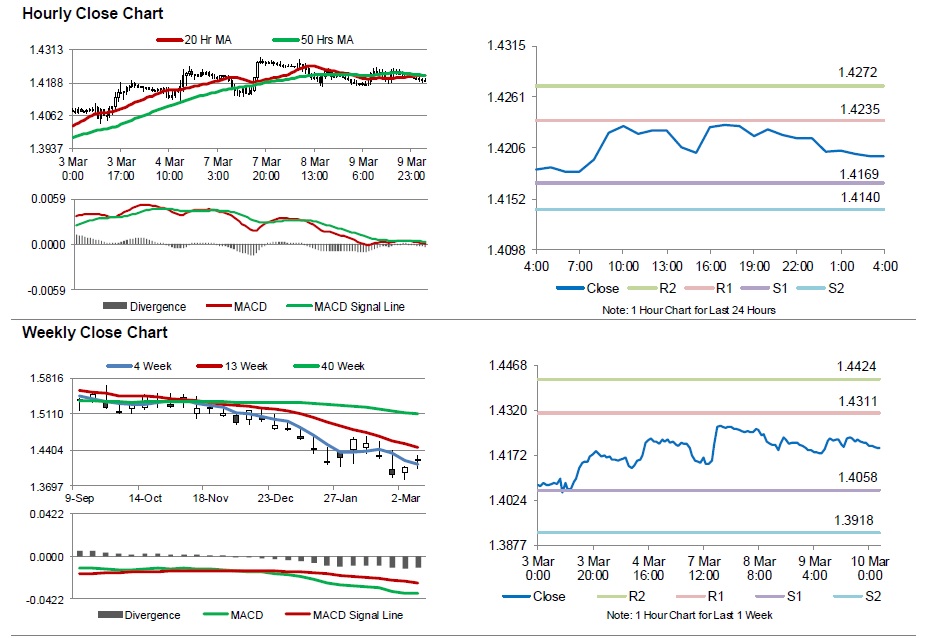

In the Asian session, at GMT0400, the pair is trading at 1.4198, with the GBP trading 0.13% lower from yesterday’s close.

Early this morning, Britain’s RICS housing price balance rose to a level of 50.0 in February, in line with investor expectations, following a revised reading of 48.0 in the previous month.

The pair is expected to find support at 1.4169, and a fall through could take it to the next support level of 1.4140. The pair is expected to find its first resistance at 1.4235, and a rise through could take it to the next resistance level of 1.4272.

Moving ahead, investors will look forward to UK’s consumer inflation expectations, total trade balance and construction output data, scheduled to release tomorrow.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.