For the 24 hours to 23:00 GMT, the EUR declined 1.43% against the USD and closed at 1.0690.

In economic news, industrial production in France recorded an unexpected rise of 0.40% in January, compared to market expectations for a fall of 0.30%. Industrial production had risen by a revised 1.40% in the prior month.

Yesterday, the ECB policymaker Benoit Coeure indicated that the central bank was on track to reach its projected volume in the first month of its new bond-purchase plan and is confident that it would not witness any issues in finding adequate paper to buy.

In the US, JOLTs job openings advanced to 4998.00 K in January, lower than market expectations of a rise to a level of 5039.00 K. It had recorded a revised reading of 4877.00 K in the prior month. Meanwhile, the seasonally adjusted wholesale inventories unexpectedly climbed 0.30% in January, beating market expectations for a fall of 0.10%. Also, the nation’s small business optimism index recorded a rise to 98.00, compared to a reading of 97.90 in the prior month. Market anticipations were for it were to advance to 99.00.

In the Asian session, at GMT0400, the pair is trading at 1.0681, with the EUR trading 0.08% lower from yesterday’s close.

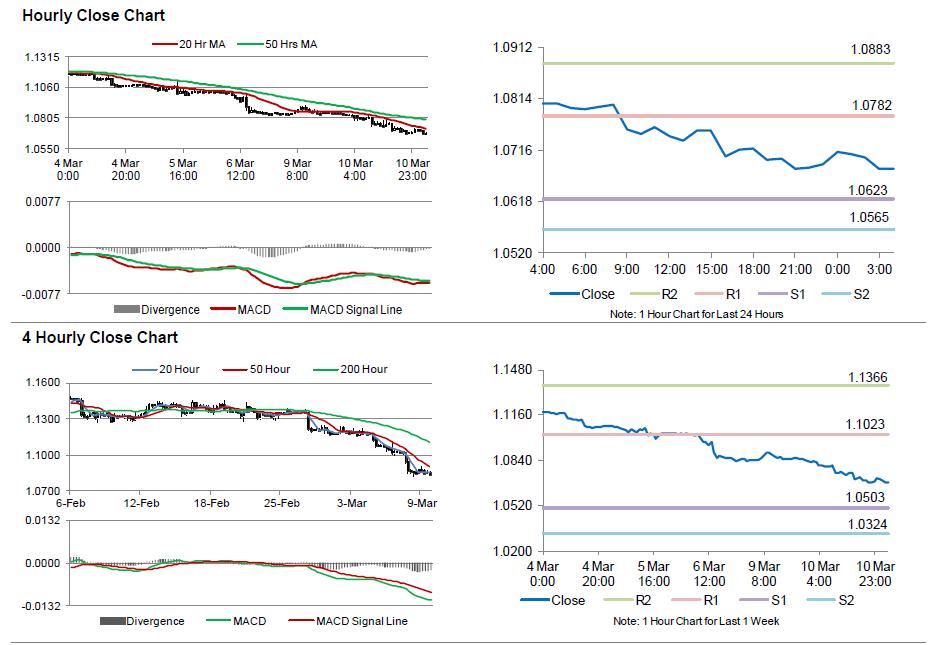

The pair is expected to find support at 1.0623, and a fall through could take it to the next support level of 1.0565. The pair is expected to find its first resistance at 1.0782, and a rise through could take it to the next resistance level of 1.0883.

Trading trends in the Euro today are expected to be determined by the ECB Chief, Mario Draghi’s speech, scheduled in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.