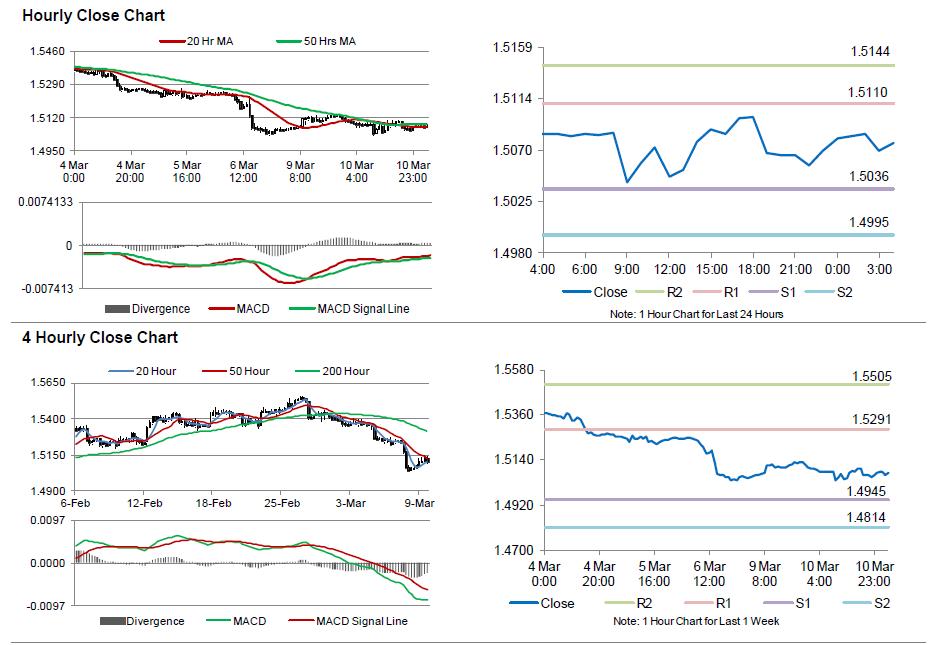

For the 24 hours to 23:00 GMT, the GBP fell 0.28% against the USD and closed at 1.5069.

Yesterday, the BoE Chief, Mark Carney, opined that it would be “extremely foolish” to cut interest rate or expand quantitative easing, as the weakness in Britain’s consumer price growth was mainly due to low energy prices. Furthermore, he also added that he expects the nation’s inflation to drop to zero and stay there for the rest of the year.

In the Asian session, at GMT0400, the pair is trading at 1.5076, with the GBP trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.5036, and a fall through could take it to the next support level of 1.4995. The pair is expected to find its first resistance at 1.511, and a rise through could take it to the next resistance level of 1.5144.

Going forward, markets participants would keep a close eye on Britain’s industrial as well as manufacturing production data, scheduled in few hours. Additionally, the nation’s NIESR GDP estimate for the three months ended February, slated for release later today, would grab lot of market attention.

The currency pair is showing convergence with its 20 Hr moving average and trading slightly below its 50 Hr moving average.