For the 24 hours to 23:00 GMT, the EUR marginally declined against the USD and closed at 1.1310.

In economic news, the Euro-zone’s seasonally adjusted trade surplus widened to a 3-month high level of €22.3 billion in March, from a revised trade surplus of €20.6 billion in the previous month. Markets were anticipating the region to post a trade surplus of €22.0 billion.

The greenback gained ground, after US consumer prices advanced more-than-expected by 0.4% MoM in April, pointing to a steady inflation build-up that could give the Federal Reserve a reason to raise interest rates later this year. Market expectation was for a rise of 0.3%, following a 0.1% gain in the previous month. Additionally, the nation’s housing starts recorded a rise of 6.6% MoM in April to an annual rate of 1172.0K, compared to a revised reading of 1099.0K in the previous month. Markets were expecting housing starts to advance to 1125.0K. Moreover, US industrial production advanced above expectations by 0.7% in April, compared to market expectations for an advance of 0.3%. Industrial production had dropped by a revised 0.9% in the prior month.

Separately, the Dallas Fed President, Robert Kaplan, stated that he will push for an interest rate hike in June or July, while the San Francisco Fed President, John Williams and the Atlanta Fed President, Dennis Lockhart, indicated that they still see two to three rate increases this year, leaving the door open for a change in monetary policy soon.

In the Asian session, at GMT0300, the pair is trading at 1.1286, with the EUR trading 0.21% lower from yesterday’s close.

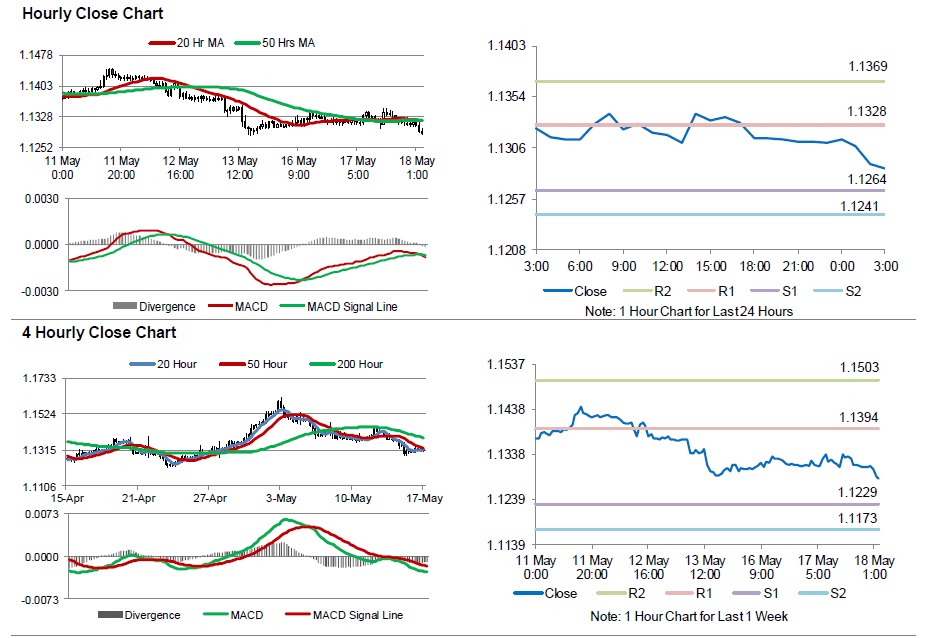

The pair is expected to find support at 1.1264, and a fall through could take it to the next support level of 1.1241. The pair is expected to find its first resistance at 1.1328, and a rise through could take it to the next resistance level of 1.1369.

Going ahead, investors will look forward to the Euro-zone’s consumer price index data for April, scheduled to release in a few hours. Additionally, the US Fed April meeting minutes, due later in the day, will also attract a lot of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.