For the 24 hours to 23:00 GMT, the GBP rose 0.30% against the USD and closed at 1.4453.

In economic news, UK’s consumer price index (CPI) advanced less-than-expected by 0.1% MoM in April, highlighting the struggle faced by the Bank of England (BoE) to revive price growth in the nation. Investors had expected the CPI to rise by 0.3%, following a 0.4% gain in the previous month. On an annual basis, the CPI rate unexpectedly fell to 0.3% in April, its first decline since September 2015, largely due to a fall in the prices of air fares, vehicles, clothing and social housing rents. Market participants had expected an advance of 0.5%, similar to the previous month’s gain.

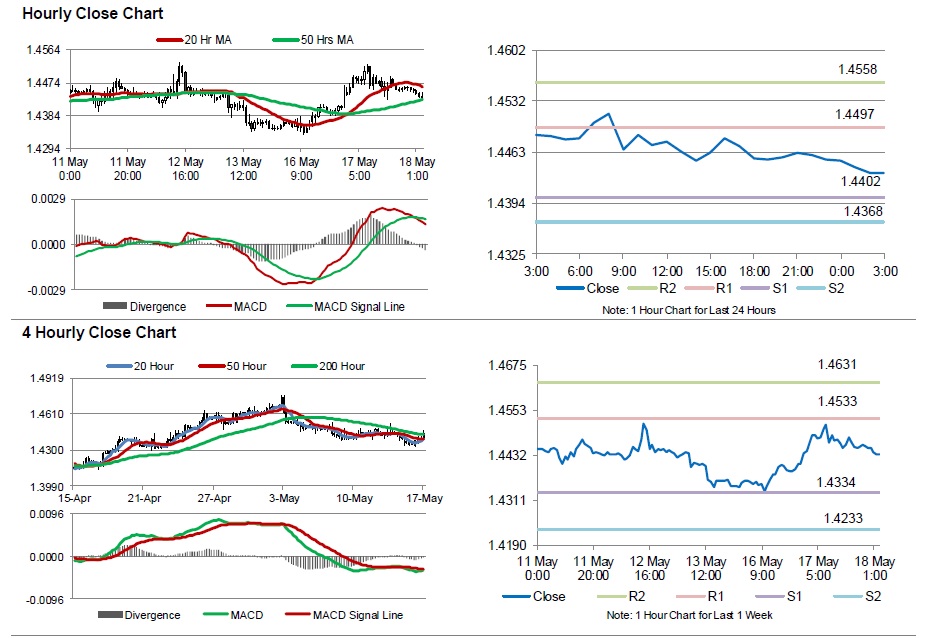

In the Asian session, at GMT0300, the pair is trading at 1.4436, with the GBP trading 0.12% lower from yesterday’s close.

The pair is expected to find support at 1.4402, and a fall through could take it to the next support level of 1.4368. The pair is expected to find its first resistance at 1.4497, and a rise through could take it to the next resistance level of 1.4558.

Moving ahead, investors will look forward to Britain’s ILO unemployment rate for the three months to March, scheduled to release in a few hours.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.