For the 24 hours to 23:00 GMT, the EUR declined 0.45% against the USD and closed at 1.1879, after the Euro-zone and its peripheries reported mixed services PMI data in

December, thus maintaining pressure on the ECB to introduce measures to spur growth in the region.

The final Markit services PMI in the Eurozone recorded a less than expected rise to 51.6 in December, compared to a reading of 51.1 in the prior month. Markets were anticipating services PMI to advance to 51.9. Meanwhile, Germany’s services PMI edged up to 52.1 in December, compared to market expectations of a drop to a level of 51.7.

Elsewhere, in France, services activity came out of contraction and entered into expansion territory in December, while Italy’s services activity surprisingly slipped into contraction territory in the same month.

Yesterday, the Vice Chancellor, Economy Minister and leader of the center-left Social Democrats, Sigmar Gabriel emphasised that the German government and the European Union was determined to keep Greece in the Euro Zone.

In the US, the ISM non-manufacturing PMI registered a drop to 56.2 in December, compared to market expectations of a drop to 58.0. In the prior month, the index had recorded a reading of 59.3. Additionally, the nation’s Markit services PMI surprisingly eased to 10-month low of 53.3 in December, compared to market expectations of a rise to a level of 53.7. Also, the US factory orders declined more than anticipated 0.7% in November, higher than market expected drop of 0.4%.

In the Asian session, at GMT0400, the pair is trading at 1.1875, with the EUR trading marginally lower from yesterday’s close.

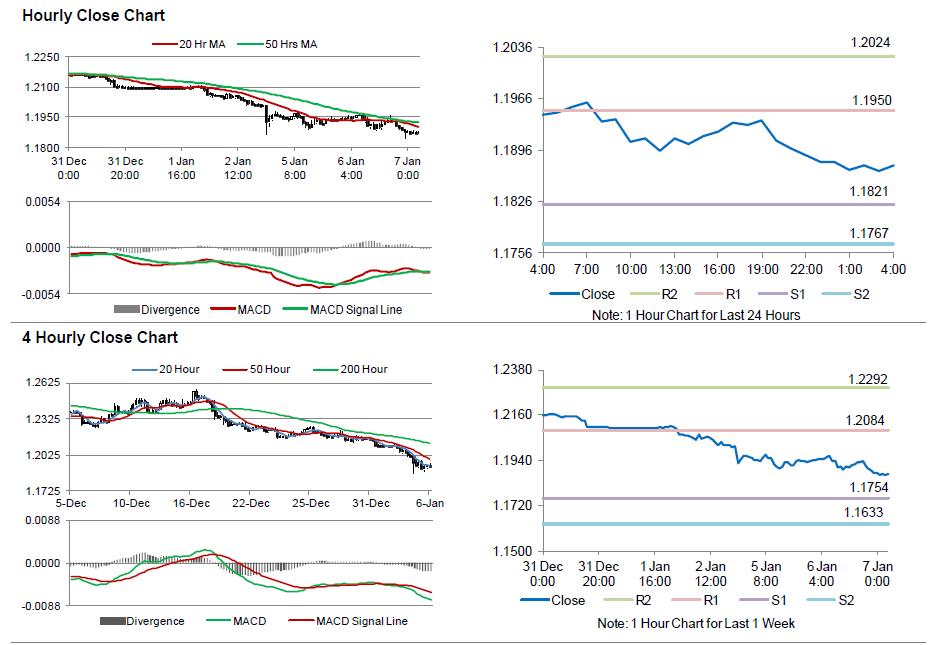

The pair is expected to find support at 1.1821, and a fall through could take it to the next support level of 1.1767. The pair is expected to find its first resistance at 1.195, and a rise through could take it to the next resistance level of 1.2024.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s inflation data, coupled with unemployment rate data, scheduled in few hours. Additionally, market participants would keep a tab on the minutes of the US Fed’s most recent policy meeting to gauge the timing of an interest rate rise this year, scheduled later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.