For the 24 hours to 23:00 GMT, the GBP fell 0.70% against the USD and closed at 1.5144, following downbeat services PMI data in the UK.

Britain’s services PMI slipped to 19-month low level of 55.8 in December lower than market expectations to ease to 58.5 and compared to prior month’s reading of 58.6, thus raising concerns over the economic health of the nation.

The Pound further came under pressure after the BoE in its quarterly credit conditions survey indicated that the UK lenders reported sharpest fall in household demand for mortgages in 1Q 2015.

In the Asian session, at GMT0400, the pair is trading at 1.5144, with the GBP trading flat from yesterday’s close.

Early morning data indicated that the UK’s BRC shop price index retreated 1.7% on a MoM basis in December, following a drop of 1.9% registered in the prior month.

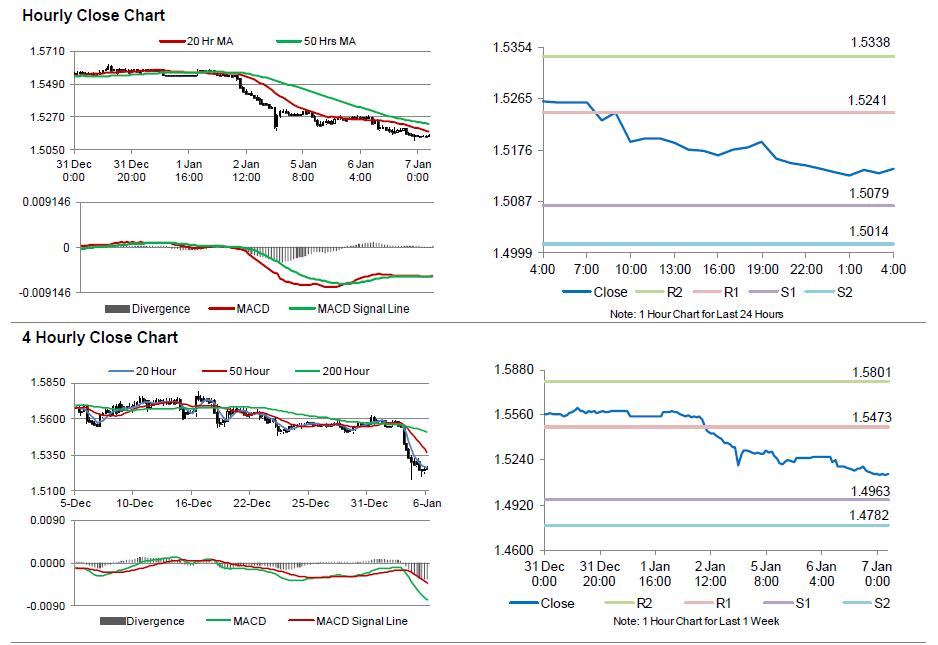

The pair is expected to find support at 1.5079, and a fall through could take it to the next support level of 1.5014. The pair is expected to find its first resistance at 1.5241, and a rise through could take it to the next resistance level of 1.5338.

Amid lack of economic releases in the UK today, investors would keep a close eye on the BoE’s policy for further hints about the central bank’s policy stance going forward, scheduled for tomorrow.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.