For the 24 hours to 23:00 GMT, the EUR rose 0.46% against the USD and closed at 1.1121.

On the macroeconomic front, in Germany, the Euro-zone’s largest economy, the GfK consumer confidence index surprisingly rose to a level of 10.1 in July, compared to investor expectations of it to remain steady at a level of 9.8. Additionally, the nation’s annual flash consumer price index (CPI) advanced in line with market expectations by 0.3% in June, following a 0.1% gain in the previous month. However, on a monthly basis, the CPI rose less-than-expected by 0.1% in June, after recording a 0.3% gain in the previous month.

Meanwhile in the Euro-zone, economic sentiment indicator unexpectedly fell to a level of 104.4 in June, mainly due to decreased optimism among consumers and managers in services, retail and construction. The indicator had registered a revised rise of 104.6 in the previous month. Additionally, the region’s final consumer confidence index remained steady at the preliminary reading of -7.3 in June. In the previous month, the consumer confidence index had registered a level of -7.0.

In the US, mortgage applications registered a drop of 2.6% in the week ended 24 June 2016, after having advanced by 2.9% in the previous week. Moreover, the nation’s pending home sales fell more-than-expected by 3.7% MoM in May, following a 3.9% revised rise in the previous month. On the other hand, the US core personal consumption expenditure advanced in line with market expectations by 0.2% MoM in May, following a similar rise in the previous month.

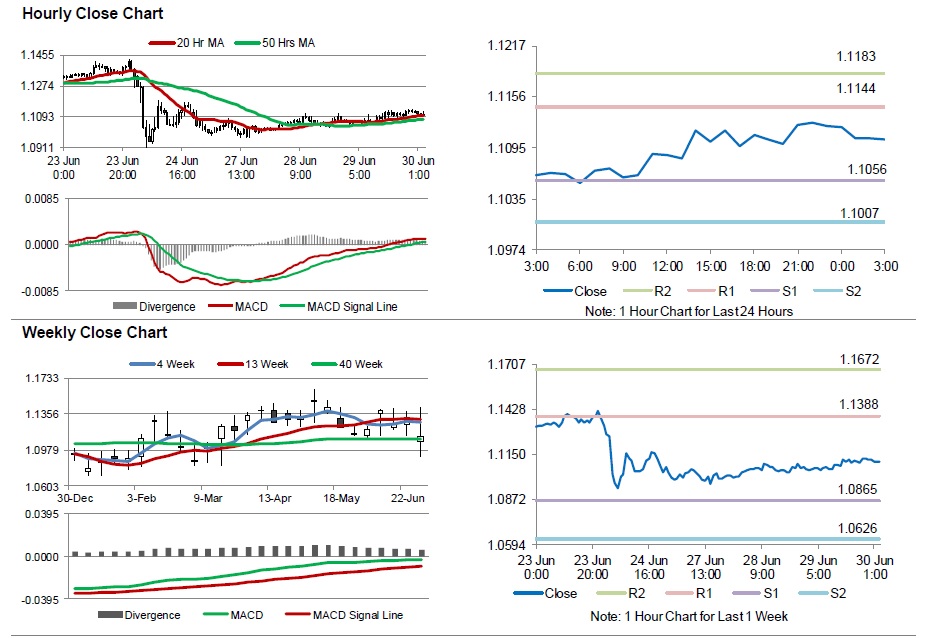

In the Asian session, at GMT0300, the pair is trading at 1.1105, with the EUR trading 0.14% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1056, and a fall through could take it to the next support level of 1.1007. The pair is expected to find its first resistance at 1.1144, and a rise through could take it to the next resistance level of 1.1183.

Going ahead, investors will look forward to Germany’s retail sales and unemployment rate data, along with the Euro-zone’s CPI data and the ECB’s monetary policy meeting accounts, scheduled to release in a few hours. Further, the US weekly jobless claims data, due later today, will also be closely eyed by market participants.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.