For the 24 hours to 23:00 GMT, the GBP rose 0.71% against the USD and closed at 1.3448, after a string of optimistic economic releases from the UK.

Yesterday, data showed that Britain’s net consumer credit advanced in line with market expectations to a level of £1.5 billion in May, notching its fastest annual rate since 2005 and after registering a level of £1.3 billion in the previous month. Moreover, the nation’s mortgage approvals surprisingly rose to a level of 67.0K in May, from a revised reading of 66.2K in the previous month. Further, UK’s seasonally adjusted nationwide house prices rose by 0.2% MoM in June, after recording a similar rise in the previous month.

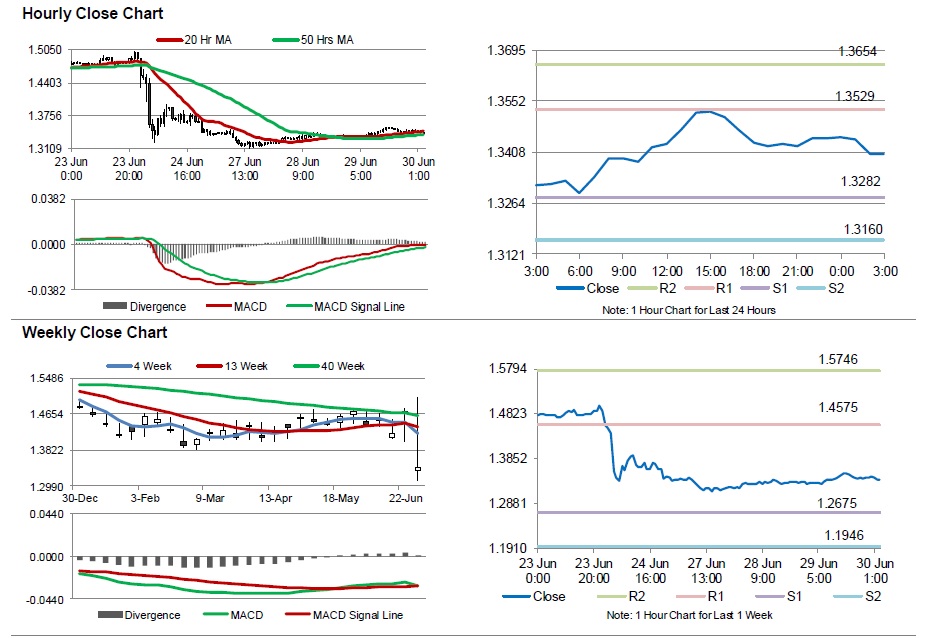

In the Asian session, at GMT0300, the pair is trading at 1.3403, with the GBP trading 0.33% lower against the USD from yesterday’s close.

Overnight data showed that Britain’s Gfk consumer confidence index remained steady at a level of -1.0 in June, compared to investor expectations for it to drop to a level of -2.0.

The pair is expected to find support at 1.3282, and a fall through could take it to the next support level of 1.3160. The pair is expected to find its first resistance at 1.3529, and a rise through could take it to the next resistance level of 1.3654.

Going ahead, market participants will look forward to UK’s final Q1 GDP data, scheduled to release in a few hours.

The currency pair is trading/showing convergence with its 20 Hr and 50 Hr moving average.