On Friday, EUR declined 0.59% against the USD and closed at 1.2533, after Germany’s retail sales fell 3.2% on a monthly basis in September, registering its biggest fall in almost 7 years, higher than market expected drop of 0.9% and compared to previous month’s rise of 1.5%.

In other economic data, the Euro-zone’s CPI data advanced 0.4% on an annual basis in October, matching market expectations and following 0.3% rise in September. Additionally, the region’s unemployment rate remained unchanged at a level of 11.5% in September.

Elsewhere, in Italy, monthly consumer prices unexpectedly climbed 0.1% on a monthly basis in October more than market expectations for a drop of 0.2%, while the nation’s unemployment rate surprisingly increased to 12.6%, beating market expectations of a drop to 12.4%.

Separately, the Bank of Italy Governor, Ignazio Visco, called for immediate measures to sustain public investments in the Euro area, as the region was facing weak economic growth.

The US Dollar traded higher after the US Michigan consumer sentiment rose to its highest level since July 2007 registering a level of 86.9 in October, up from previous month’s reading of 86.4, indicating growing consumer optimism over the US economy. Additionally, the nation’s Chicago Fed PMI unexpectedly advanced to 12-month high of 66.2 in October, higher than market expectations of a fall to 60.0. The index had registered a level of 60.5 in the prior month. Meanwhile, personal spending in the nation unexpectedly dropped 0.2% in September, less than market expectations for an advance of 0.1%, while personal income rose 0.2%, less than market expected advance of 0.3% in the same month.

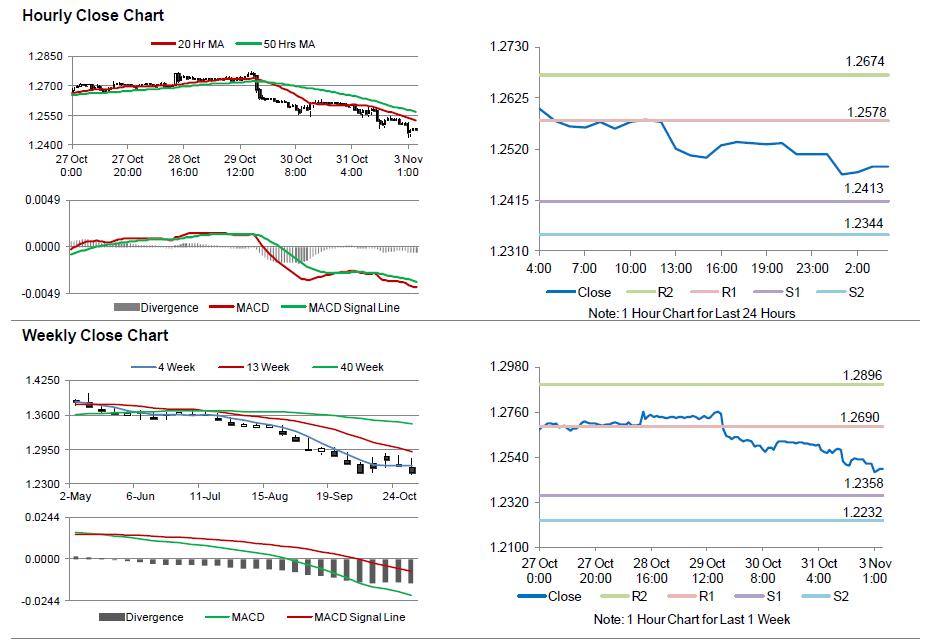

In the Asian session, at GMT0400, the pair is trading at 1.2483, with the EUR trading 0.4% lower from Friday’s close.

The pair is expected to find support at 1.2413, and a fall through could take it to the next support level of 1.2344. The pair is expected to find its first resistance at 1.2578, and a rise through could take it to the next resistance level of 1.2674.

Trading trends in the Euro today are expected to be determined by the manufacturing PMI data from the Euro-zone and its peripheries, scheduled in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.