On Friday, GBP traded a tad higher against the USD and closed at 1.5999.

The BoE’s Financial Policy Committee imposed a milder regulatory leverage ratio for the UK bank at a lower than expected level, which would come into effect in 2019. Banks in the UK .would face a basic leverage ratio of 4.05%, which could go up to 4.95% if required to cool excess credit or balance-sheet growth.

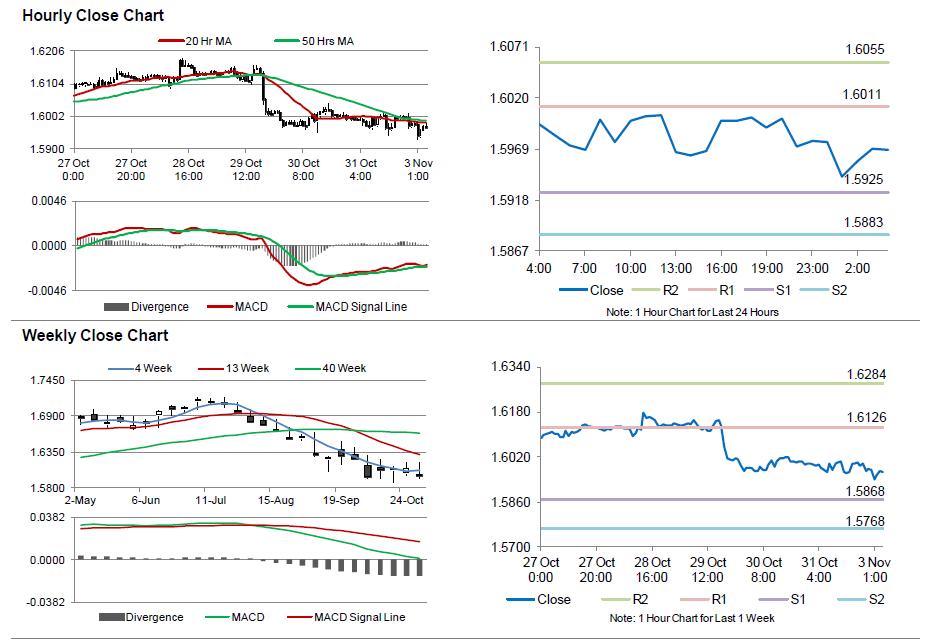

In the Asian session, at GMT0400, the pair is trading at 1.5968, with the GBP trading 0.19% lower from Friday’s close.

The pair is expected to find support at 1.5925, and a fall through could take it to the next support level of 1.5883. The pair is expected to find its first resistance at 1.6011, and a rise through could take it to the next resistance level of 1.6055.

Trading trends in the Pound today would be determined by Britain’s manufacturing PMI, scheduled in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.