For the 24 hours to 23:00 GMT, the EUR declined 0.38% against the USD and closed at 1.1378, after the Euro-zone’s industrial output fell sharply for the second consecutive month.

Data showed that the region’s seasonally adjusted industrial production unexpectedly declined by 0.8% MoM in March, as all sectors except energy contracted from February. Investors had expected it to post a flat reading, after falling by 0.8% in the previous month.

The greenback gained ground, following hawkish comments from three voting members of the US Federal Reserve (Fed). The Kansas City Fed President, Esther George, stated that interest rates are too low for the current US economic situation, while the Cleveland Fed President, Loretta Mester, indicated that US headline and core inflation have moved higher, which was “encouraging and consistent with the Fed’s view.” Additionally, the Boston Fed President, Eric Rosengren, expressed confidence in the US economy and stated that the nation was strong enough to withstand a rate rise.

In other economic news, US initial jobless claims surprisingly climbed to a level of 294.0K in the week ended 07 May 2016, compared to market expectations of a drop to a level of 270.0K. In the prior week, initial jobless claims had recorded a level of 274.0K.

In the Asian session, at GMT0300, the pair is trading at 1.1368, with the EUR trading 0.09% lower from yesterday’s close.

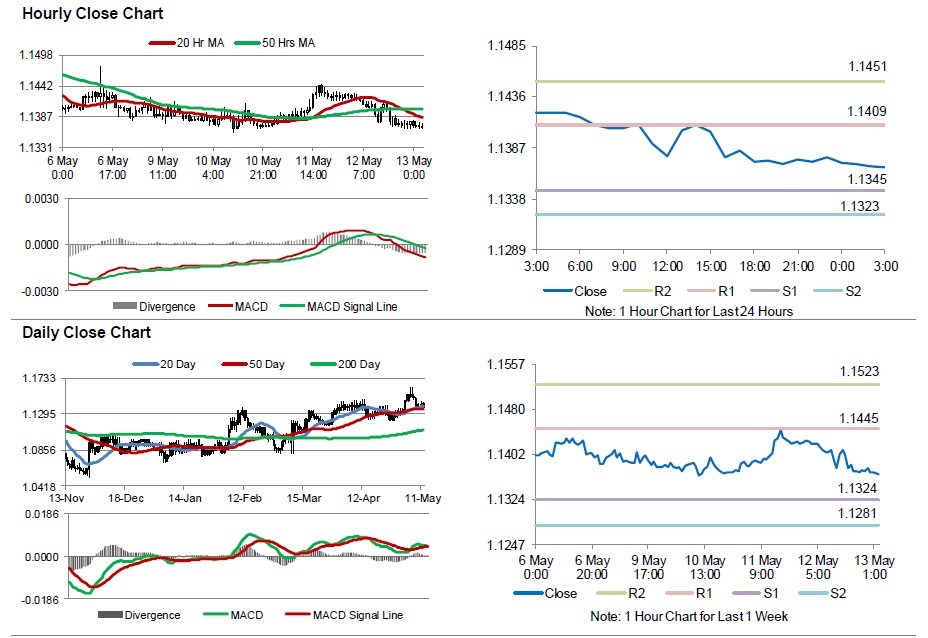

The pair is expected to find support at 1.1345, and a fall through could take it to the next support level of 1.1323. The pair is expected to find its first resistance at 1.1409, and a rise through could take it to the next resistance level of 1.1451.

Moving ahead, investors will look forward to Germany’s consumer price inflation data for April, along with the Euro-zone’s and Germany’s Q1 GDP data, scheduled to release in a few hours. Moreover, US advance retail sales and the Reuters/Michigan consumer sentiment index data, both for the month of April, will also grab a significant amount of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.