For the 24 hours to 23:00 GMT, the GBP rose 0.07% against the USD and closed at 1.4446, after the Bank of England (BoE) in a widely expected move left benchmark interest rate unchanged at a seven-year low level of 0.5%. The policymakers also unanimously voted to maintain the asset purchase facility at £375.0 billion. In a statement accompanying the rate decision, the BoE Governor, Mark Carney, warned that a vote for Brexit could lead to an increase in the nation’s unemployment rate and the pound could fall sharply and might even lead to recession. Further, in the central bank’s quarterly inflation report, published simultaneously with the rate decision, the BoE forecasted Britain’s economy to grow by 2.0% this year and 2.3% in 2017, down from its earlier forecasts of 2.2% and 2.4%, respectively.

In the Asian session, at GMT0300, the pair is trading at 1.4433, with the GBP trading 0.09% lower from yesterday’s close.

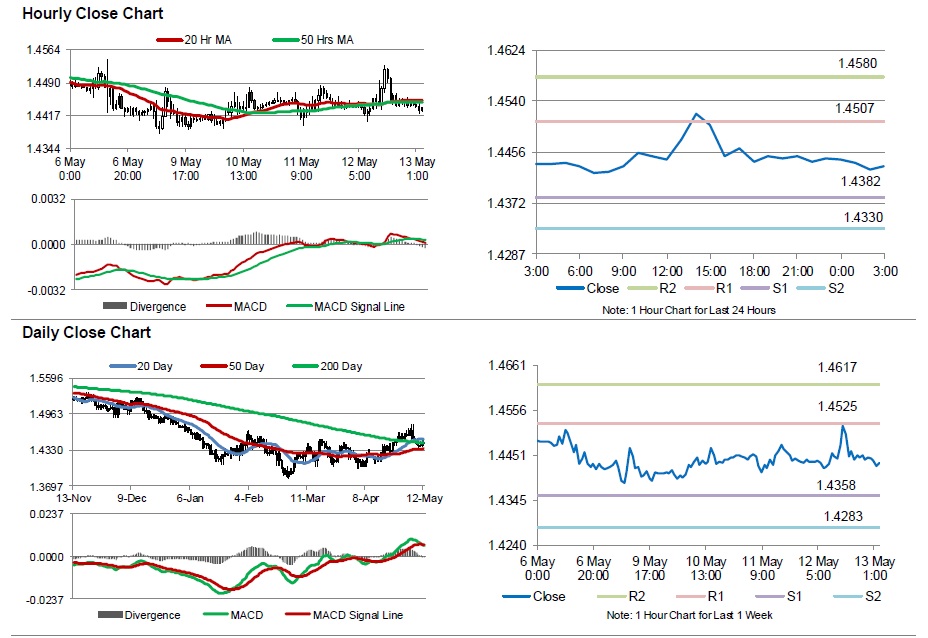

The pair is expected to find support at 1.4382, and a fall through could take it to the next support level of 1.4330. The pair is expected to find its first resistance at 1.4507, and a rise through could take it to the next resistance level of 1.4580.

Going ahead, investors will look forward to UK’s construction output data for March, scheduled to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.