For the 24 hours to 23:00 GMT, the EUR rose 0.35% against the USD and closed at 1.2475.

In economic news, monthly consumer prices in Germany, registered a drop of 0.3% in October, registering a 4th consecutive month of decline, at par with market expectations, thus indicating that the Euro-zone’s biggest economy continues to face the risk of deflation.

Elsewhere, in France, the EU normalised CPI stagnated on a monthly basis in October, following a drop of 0.4% registered in the prior month, while monthly inflation in Italy rebounded 0.1% in October, in line with market expectations and after retreating 0.4% in the preceding month. On the other hand, Spain’s final consumer price index climbed 0.5% on a monthly basis in October, following a rise of 0.2% registered in September.

Separately, the ECB in its monthly report for November reported that under its new monetary expansionary policy programme, it would start buying asset-backed securities in order to boost the region’s economic growth.

Yesterday, the ECB’s Executive Board Member, Benoit Coeure, expressed concerns over low-inflation prevailing in the Euro-zone and indicated that sovereign bond-buying is “one of the options” for the central bank to add further stimulus measure to the struggling Euro-economy.

The greenback lost ground after, number of people claiming initial jobless claims in the US climbed to 290.0 K in the week ended 08 November, higher than market anticipated rise to 280.0 K and following a level of 278.0 K registered in the prior week. Additionally, continuing claims unexpectedly rose to a level of 2392.0 K in the week ended 01 November, higher than market expectations to fall to 2349.0 K. Meanwhile, the nation registered a budget deficit of $121.71 billion in October, compared to a budget surplus of $105.80 billion in the prior month, while markets were anticipating a budget deficit of $111.70 billion. Also, JOLTs job openings dropped to 4735.0 K in September, while markets anticipated it to drop to 4800.0 K.

Yesterday, the Fed Chairwoman, Janet Yellen, opined that the central bank should keep a close eye on the overseas economic developments and how they may affect the US economy, so as to achieve its objectives of full employment and price stability.

Separately, the New York Fed President, William Dudley opined that it would be premature to start raising its interest rates in the US as the labour market and inflation continued to be weak.

Meanwhile, the Minneapolis Fed President, Narayana Kocherlakota, indicated that he could support a hike in interest rate in 2015, if inflation rises faster than he expects.

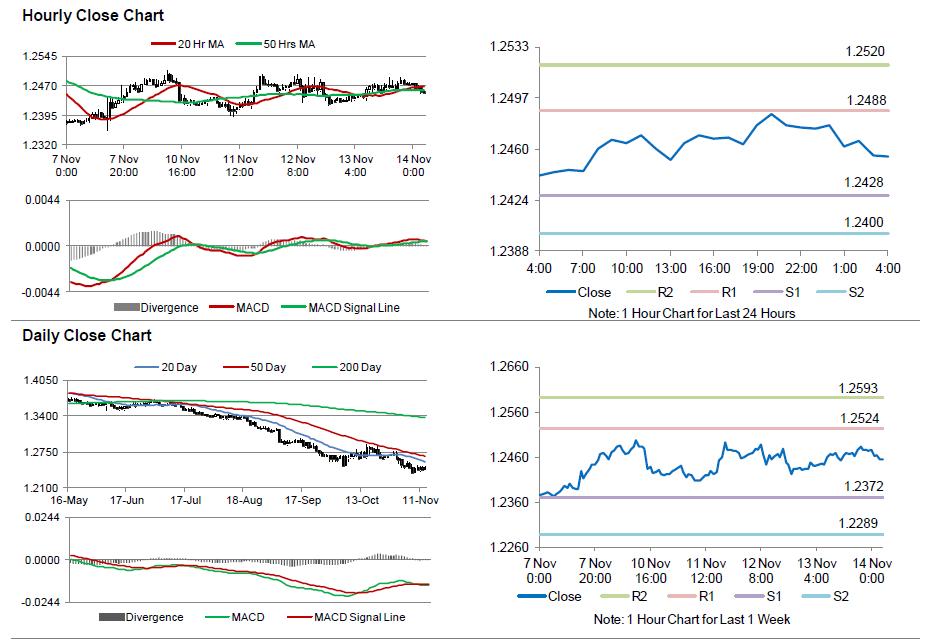

In the Asian session, at GMT0400, the pair is trading at 1.2455, with the EUR trading 0.16% lower from yesterday’s close.

The pair is expected to find support at 1.2428, and a fall through could take it to the next support level of 1.2400. The pair is expected to find its first resistance at 1.2488, and a rise through could take it to the next resistance level of 1.2520.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s as well as it peripheries GDP data, scheduled in a few hours. Meanwhile, the US advance retail sales and consumer confidence data would keep investor on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.