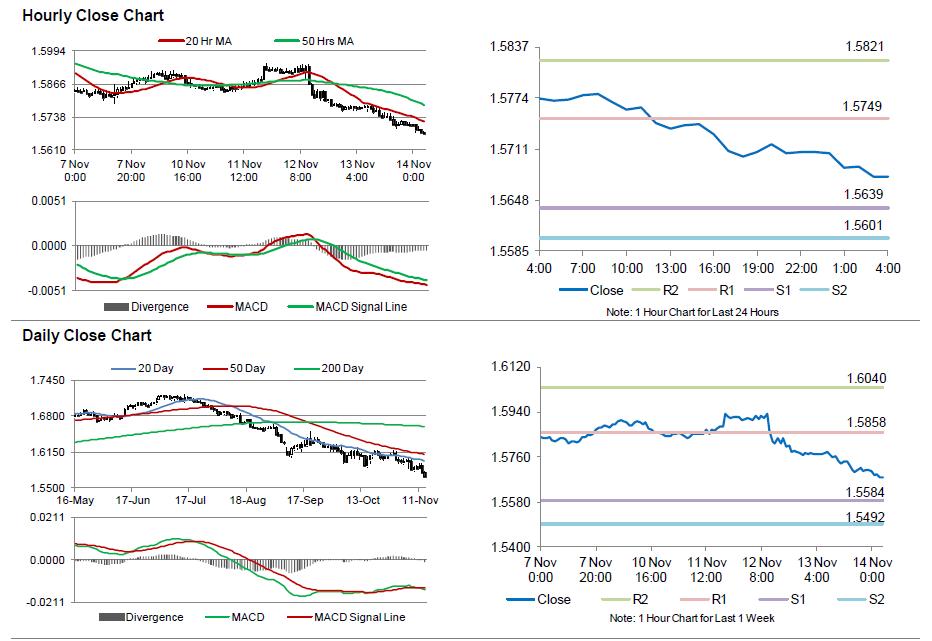

For the 24 hours to 23:00 GMT, the GBP fell 0.38% against the USD and closed at 1.5707.

Yesterday, the BoE’s Deputy Governor, Ben Broadbent reiterated that interest rate hike in the UK would be limited and gradual. However, he urged that the wages and productivity in the nation should improve in order to have a sustained economic recovery.

In the Asian session, at GMT0400, the pair is trading at 1.5677, with the GBP trading 0.19% lower from yesterday’s close.

The pair is expected to find support at 1.5639, and a fall through could take it to the next support level of 1.5601. The pair is expected to find its first resistance at 1.5749, and a rise through could take it to the next resistance level of 1.5821.

Amid a light economic calendar from Britain today, investors look forward to construction output data for further cues.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.