On Friday, the EUR declined 0.39% against the USD and closed at 1.1111, after the Euro-zone’s as well as the German economy grew less than market forecasts in the second quarter of 2015.

Data indicated that Germany economy expanded 0.4% QoQ in the June quarter, lower than market expected growth of 0.5% and following a gain of 0.3% in the prior quarter, while the Euro-zone’s GDP growth slowed down to 0.3% in the same period, compared to a rise of 0.4% in the previous quarter, thus suggesting that the Euro economy is still struggling to recover from the economic crisis, despite the ECB’s large monetary stimulus efforts.

Elsewhere, in France, the Euro-zone’s second biggest economy, growth came to a standstill, after the nation registered strong GDP figures in the previous quarter, while Italy’s economy grew by 0.2% QoQ in the second quarter, following a 0.3% expansion recorded in the first quarter.

Separately, consumer price inflation in the common-currency bloc dropped 0.60% on a monthly basis in July, in line with market expectations. The index had recorded a flat reading in the previous month, thereby highlighting that inflation in the Euro-zone is still below the central bank’s projected target of 2.0%.

Meanwhile, the Eurozone finance ministers agreed on a new bailout deal for Greece worth €86bn to be made over the next three years, ensuring that the nation would continue to be a part of the Euro-zone. The bailout agreement demands more tough spending cuts and tax rises.

The greenback gained ground, following the release of upbeat industrial production data in the US.

Data released showed that the US industrial production climbed more than expected by 0.6%, marking its biggest gain since November in the month of July and compared to a revised increase of 0.1% in the previous month.

Other economic data showed that the preliminary August reading of the University of Michigan’s consumer sentiment index unexpectedly dipped to 92.9, from prior month’s level of 93.1.

In the Asian session, at GMT0300, the pair is trading at 1.1097, with the EUR trading 0.13% lower from Friday’s close.

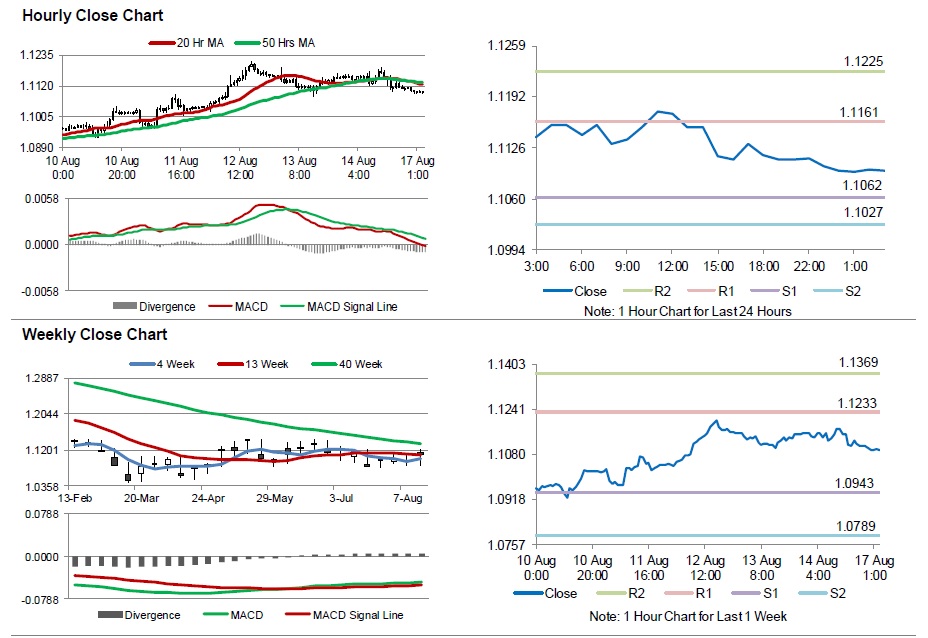

The pair is expected to find support at 1.1062, and a fall through could take it to the next support level of 1.1027. The pair is expected to find its first resistance at 1.1161, and a rise through could take it to the next resistance level of 1.1225.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s trade balance data, scheduled in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.