On Friday, the GBP marginally rose 0.23% against the USD and closed at 1.5645.

In economic news, Britain construction output growth rose moderately by 0.9% on a MoM basis in June, against market expected increase of 2.0% and following a revised drop of 1.0% recorded in the preceding month.

In the Asian session, at GMT0300, the pair is trading at 1.5651, with the GBP trading a tad higher from Friday’s close.

Overnight data showed that Britain’s Rightmove house price index fell 0.80% on a monthly basis in August. In the previous month, the index had registered a rise of 0.10%.

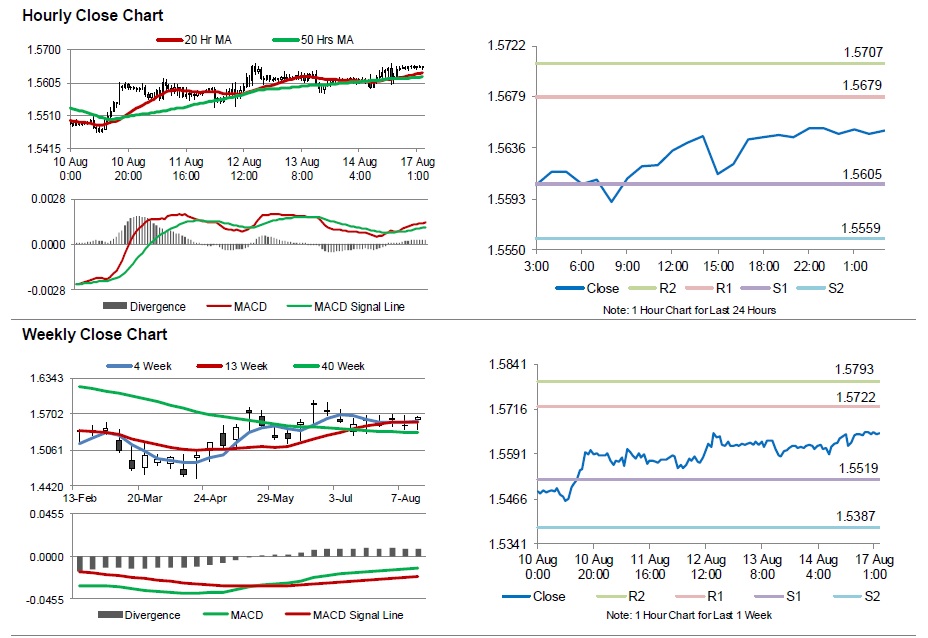

The pair is expected to find support at 1.5605, and a fall through could take it to the next support level of 1.5559. The pair is expected to find its first resistance at 1.5679, and a rise through could take it to the next resistance level of 1.5707.

Looking ahead, investors will eye Britain’s crucial consumer prices data, scheduled tomorrow.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.