For the 24 hours to 23:00 GMT, the EUR rose 0.43% against the USD and closed at 1.1847, despite political upheaval in Spain after the Spanish government threatened to suspend Catalonia’s autonomy and take control as the region’s leader, Carles Puigdemont, refused to abandon a push for independence.

Macroeconomic data released in the US showed that first time claims for the US unemployment benefits dropped to a level of 222.0K in the week ended 14 October, hitting its lowest level since March 1973, thus pointing to a strong labour market growth that would allow the Federal Reserve to hike interest rate again in December. Markets had expected initial jobless claims to fall to a level of 240.0K, after recording a revised level of 244.0K in the previous week. Further, the nation’s Philadelphia Fed manufacturing index unexpectedly climbed to a five-month high level of 27.9 in October, compared to a level of 23.8 in the prior month, while markets were expecting the index to ease to a level of 22.0.

On the other hand, the nation’s leading indicators unexpectedly retreated 0.2% in September, defying market consensus for a gain of 0.1% and following an advance of 0.4% in the prior month.

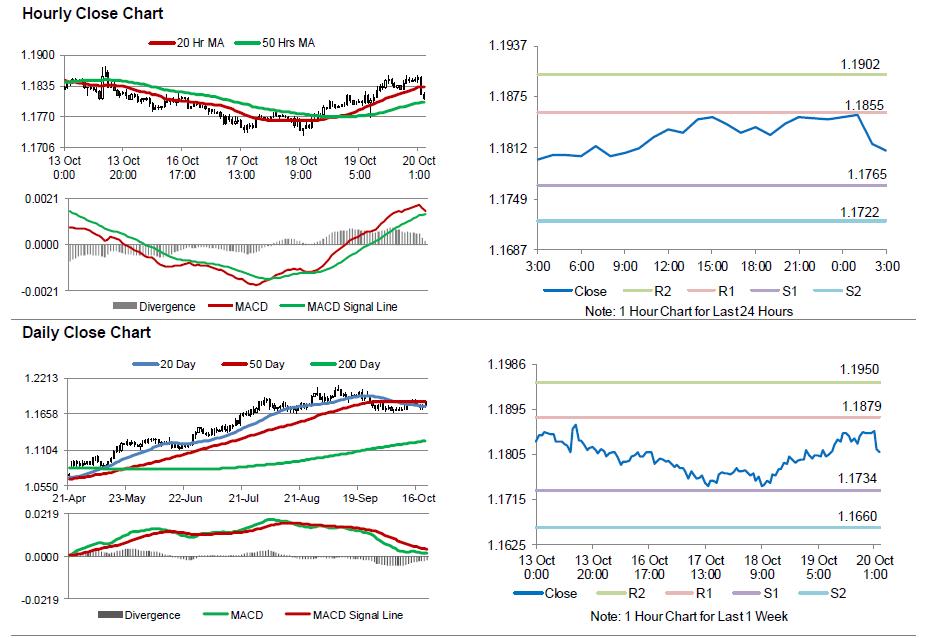

In the Asian session, at GMT0300, the pair is trading at 1.1809, with the EUR trading 0.32% lower against the USD from yesterday’s close, as the greenback strengthened after the US Senate voted to approve a budget blueprint that will allow the Republicans to pursue a tax-cut package without Democratic support.

The pair is expected to find support at 1.1765, and a fall through could take it to the next support level of 1.1722. The pair is expected to find its first resistance at 1.1855, and a rise through could take it to the next resistance level of 1.1902.

Going ahead, investors would eye the Euro-zone’s current account balance data for August, slated to release in a few hours. Moreover, the US existing home sales data for September, slated to release later in the day, would keep investors on their toes.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.