For the 24 hours to 23:00 GMT, the GBP declined 0.41% against the USD and closed at 1.3155, following weaker-than-expected UK retail sales figures.

Data showed that Britain’s retail sales declined more-than-expected by 0.7% on a monthly basis in September, suggesting that accelerating inflation is squeezing household incomes and holding back the growth of retail sector. Retail sales had registered a revised advance of 0.9% in the prior month, while investors had envisaged for a drop of 0.2%.

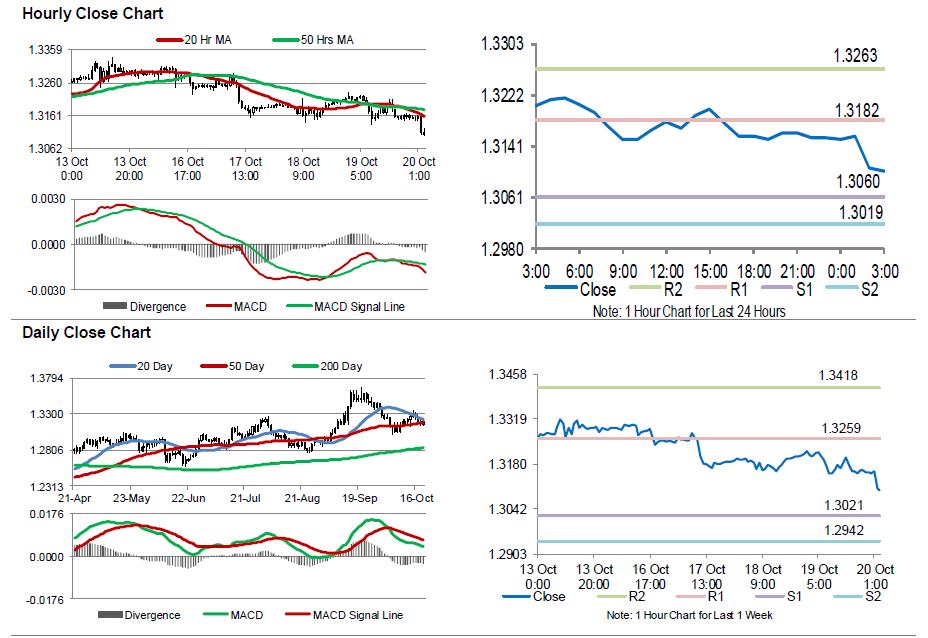

In the Asian session, at GMT0300, the pair is trading at 1.3101, with the GBP trading 0.41% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.3060, and a fall through could take it to the next support level of 1.3019. The pair is expected to find its first resistance at 1.3182, and a rise through could take it to the next resistance level of 1.3263.

Moving ahead, traders would direct their attention to the UK’s public sector net borrowing data for September, slated to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.